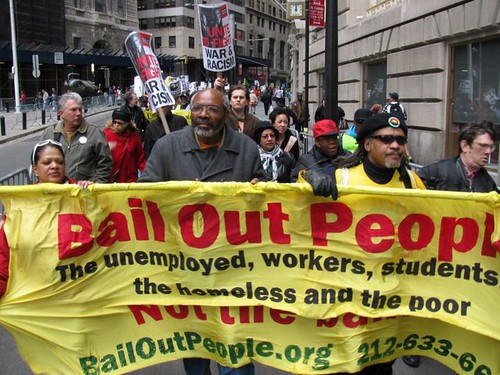

Abayomi Azikiwe, editor of the Pan-African News Wire, covering the April 4, 2009 anti-war demonstration on Wall Street. (Photo: Alan Pollock), a photo by Pan-African News Wire File Photos on Flickr.

JULY 13, 2011, 10:54 P.M. ET

Asia Falls on Moody's Warning

By JOHN PHILLIPS

Wall Street Journal

SINGAPORE--Asian stock markets were lower Thursday and the U.S. dollar fell across the board, as sentiment was hurt after Moody's Investors Service warned of a possible downgrade of U.S. government debt.

Japan's Nikkei Stock Average fell 0.4%, Australia's S&P/ASX 200 slid 0.3%, South Korea's Kospi Composite lost 0.8% and New Zealand's NZX-50 fell 0.4%.

Dow Jones Industrial Average futures were down 22 points in screen trade.

The U.S. dollar took a beating after Moody's put its Aaa rating on U.S. government bonds on watch for a possible downgrade Wednesday, citing the "rising possibility that the statutory debt limit will not be raised on a timely basis."

The yen rose on the greenback's woes, prompting Japanese Finance Minister Yoshihiko Noda to warn earlier Thursday that the yen's movement "is far out line with real fundamentals and is one-sided." The dollar also slumped to a three-year low against the Korean won at 1,054, underscoring the brittle market sentiment around sovereign debt issues amid the anxiety over the European debt crisis.

The dollar was already on the defensive after Fed Chairman Ben Bernanke told legislators Wednesday that the Fed was "prepared to respond" if stimulus was needed, signaling to some that he was keeping the door open for a third round of quantitative easing.

Apart from the euro-zone's debt problems, "a big unresolved issue for markets across the world is the U.S. deficit ceiling situation," said Ben Le Brun, market analyst at CMC Markets in Sydney. "The August 2 deadline creeps ever closer and it is looking more and more complex for both sides of U.S. parliament to strike a deal," he said.

The Sydney market was hurt by a late Wednesday profit warning from David Jones.

David Jones shares slumped 15% after the upmarket department store retailer said that first-half profit for fiscal 2012 could fall 20% after an "unprecedented" deterioration in trading conditions in the fourth quarter.

The dour profit forecast also hurt other retailers, with Myer, Harvey Norman, Billabong falling 3.7%-5.7%, while media stocks Seven West Media, Ten and Fairfax dropped 1.8%-4.2%.

News Corp., the owner of this newswire, rose 5.0% after Wednesday abandoning its $14 billion bid for the 61% of satellite television provider British Sky Broadcasting Plc that it doesn't already own. The bid was pulled amid a scandal over reporting tactics at one of News Corp.'s U.K. tabloid newspapers.

In Tokyo, the stronger yen continued to weigh on exporter stocks, dragging the market lower.

Among exporters Toyota Motor fell 0.9%, Sony slid 1.6% and Nikon lost 0.8%.

Toyota Auto Body jumped 9.7% and Kanto Auto Works climbed 4.5% after Toyota Motor said Wednesday it will turn the two car assembly subsidiaries into wholly owned units in January through share swaps.

The Seoul market was down, and was largely unmoved by the Bank of Korea's widely expected decision to keep its policy rate steady at 3.25%.

Tech shares were hurt by weak earnings growth momentum, while investors were also wary ahead of a Kospi options expiry later in the session.

"Volatile trades will likely continue throughout this week. There are number of issues that investors feel uncertain about," including the euro-zone leaders' summit on helping Greece overcome its debt problems, said Hyundai Securities analyst Bae Sung-young.

Samsung Electronics fell 1.9% and LG Electronics slid 1.6%, while Hynix Semiconductor rose 0.4% on bargain-buying after a three-day losing streak.

In foreign exchange markets, the dollar was down across the board, with the euro receiving some respite from Europe's own debt problems.

Despite the warning from Japanese Finance Minister Noda about the yen's strength, some traders say policy makers won't intervene now. "It's inevitable that Noda, as the point man on intervention, has to try to talk the yen down like this, but I think it's unlikely that there'd be any intervention now as the Kan government doesn't have the political wherewithal for it," said Toshihiko Sakai, chief manager of forex and financial products trading at Mitsubishi UFJ Trust and Banking.

The single currency was at $1.4248 against the dollar, from $1.4158 late Wednesday in New York, and at ¥111.88 against the yen, from ¥111.82. The dollar was at ¥78.54, from ¥79.01.

September Japanese government bond futures were up 0.10 at 141.52 points.

Spot gold was at $1,587.00 per troy ounce, up $4.40 from its New York settlement on Wednesday. August Nymex crude oil futures were down four cents at $98.01 per barrel on Globex.

No comments:

Post a Comment