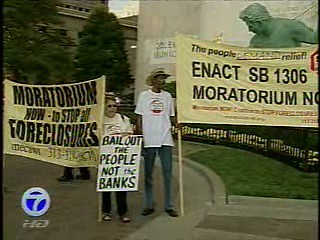

Members of the Moratorium Now! Coalition to Stop Foreclosures and Evictions held a protest demonstration against the bailout of Wall Street. This event occured on Sept. 25, 2009 in downtown Detroit. (Channel 7 Photo)., a photo by Pan-African News Wire File Photos on Flickr.

S&P 500 Erases 2011 Gain as Investors Grow Concerned Recovery Faltering

By Rita Nazareth - Aug 2, 2011

U.S. stocks tumbled, erasing the 2011 gain for the Standard & Poor’s 500 Index, after an unexpected decline in consumer spending increased concern that growth in the world’s largest economy is faltering.

United Technologies Corp. (UTX) and Caterpillar Inc. (CAT) dropped at least 3.5 percent, pacing losses in companies most-dependent on economic growth. The Dow Jones Transportation Average, which is considered a proxy for the economy, slumped 3.7 percent. Ford Motor Co. (F) retreated 4.1 percent as sales increased less than analysts estimated. Coach Inc. (COH), the largest U.S. luxury handbag maker, declined 6.5 percent after saying that a measure of profitability may not improve this year amid higher costs.

The S&P 500 fell 2.6 percent, the most in a year, to a seven-month low of 1,254.05 at 4 p.m. in New York. The gauge has fallen for seven straight days, its longest slump since October 2008. The Dow Jones Industrial Average lost 265.87 points, or 2.2 percent, to 11,866.62. Stocks extended losses even after the Senate passed legislation to raise the debt limit.

“We’re in a sluggish economy,” Mark Bronzo, a money manager at Security Global Investors in Irvington, New York, said in a phone interview. His firm manages $26 billion. “Now that we’ve moved past the debt ceiling fears, people are really focused on growth. The market is very unforgiving. We’re in this period where people don’t love the stock market. They think economic growth is slow. So, there’s a flight to safety.”

Today’s Deadline

The S&P 500 slumped 8 percent from this year’s high on April 29 amid concern about Europe’s debt crisis and speculation that U.S. lawmakers would fail to reach a compromise to boost the nation’s ability to borrow by a deadline set for today. The index was still up 2.3 percent this year through yesterday on government stimulus measures and higher-than-estimated earnings. After today’s decline, it was down 0.3 percent in 2011.

The benchmark gauge retreated below its average price of the last 200 days of about 1,286. A drop below the 200-day moving average might trigger further losses, according to analysts who study charts to make forecasts.

Stocks fell after Commerce Department figures showed purchases slid 0.2 percent, after a 0.1 percent gain the prior month. It was the first drop in consumer spending in almost two years. The median estimate of 77 economists surveyed by Bloomberg News called for a 0.1 percent increase. Incomes grew at the slowest pace since November and the savings rate climbed.

Confidence Slump

A slump in confidence threatens to derail the economy. The Thomson Reuters/University of Michigan final index of consumer sentiment fell in July to the weakest since March 2009. The Bloomberg Consumer Comfort Index also dropped in the week ended July 24 to the lowest since May. Gross domestic product climbed at a 1.3 percent annual rate in the second quarter after a 0.4 percent gain in the prior period that was less than earlier estimated, Commerce Department figures showed July 29.

Auto companies are feeling the pinch as consumers rein in spending. Ford slumped 4.1 percent to $11.85 as its light- vehicle sales rose 5.9 percent to 180,315 vehicles from 170,208 a year earlier, the Dearborn, Michigan-based automaker said today. The average estimate of six analysts surveyed by Bloomberg was for a 7.6 percent increase in Ford sales.

General Motors Co. (GM) predicted industrywide deliveries for July may be little changed from a year earlier as consumers reduce spending. Its shares dropped 3.6 percent to $27.05.

Apparel Weakness

An S&P 500 gauge of companies that make apparel, appliances and other consumer products tumbled 4.9 percent, the biggest decline within 24 S&P 500 groups. Coach fell 6.5 percent to $61.03. Chief Financial Officer Mike Devine said that gross margin, the share of sales left after subtracting the cost of goods sold, would be “essentially flat” in the current fiscal year compared with the previous year.

The Morgan Stanley Cyclical Index of 30 companies slumped 3.7 percent. United Technologies, the maker of Pratt & Whitney jet engines, retreated 4.1 percent to $78.93. Caterpillar, the world’s largest construction and mining-equipment maker, declined 3.5 percent to $97.18. All 20 stocks in the Dow Jones Transportation Average fell, sending the index to the lowest level since November.

Harvard University economics professor Martin Feldstein said the U.S. recovery that began two years ago has been losing steam and there are even odds the economy will slip into a recession.

“This economy is really balanced on the edge,” Feldstein said in an interview on Bloomberg Television’s “Surveillance Midday” with Tom Keene. “I think there’s now a 50 percent chance that we could slide into a new recession.”

Debt Deal

The Senate voted to ratify a U.S. debt-limit compromise that will avert a default even as it defers decisions on the nation’s finances to a bipartisan panel and may only modestly reduce deficits. The House late yesterday approved the measure, which raises the national debt ceiling enough to fund the government until 2013 and threatens automatic spending cuts to enforce a goal of cutting $2.4 trillion over the next decade.

Bill Gross, who runs the world’s biggest bond mutual fund at Pacific Investment Management Co., said the debt ceiling compromise reached by Congress won’t make a “significant dent” in U.S. deficits.

“In addition to an existing nearly $10 trillion of outstanding Treasury debt, the U.S. has a near unfathomable $66 trillion of future liabilities at net present cost,” he wrote.

Fitch Ratings said the U.S. remains under a review as the nation’s debt burden increases at a pace that isn’t consistent with an AAA sovereign credit rating. Fitch said it expects to complete the ratings review by the end of August, given the approval today by Congress of a debt-limit compromise that prevents a U.S. default.

‘Tough Choices’

While the agreement is a “step in the right direction,” the U.S. must confront “tough choices on tax and spending against a weak economic backdrop if the budget deficit and government debt is to be cut,” Fitch said in a statement today.

Both S&P and Moody’s Investors Service are still weighing whether to cut the U.S. credit rating. S&P said in July that the impasse boosted to 50 percent the chance that it will downgrade the U.S. from AAA within three months.

Archer Daniels Midland Co. slumped 6.2 percent to $28.60. The world’s largest grain processor reported fiscal fourth- quarter profit that missed analysts’ estimates after corn and tax expenses rose.

MetroPCS Communications Inc. (PCS) tumbled 37 percent to $10.26, after a 35 percent decline led to a pause in trading on the New York Stock Exchange. The mobile-phone carrier reported second- quarter sales of $1.21 billion. On average, the analysts surveyed by Bloomberg estimated revenue of $1.23 billion.

On average, profit per share for the S&P 500 companies that reported results since July 11 has grown 18 percent, according to data compiled by Bloomberg. Energy, raw-material and technology companies in the index have shown the biggest increases in earnings per share, with each group growing at least 32 percent.

To contact the reporter on this story: Rita Nazareth in New York at rnazareth@bloomberg.net

To contact the editor responsible for this story: Nick Baker at nbaker7@bloomberg.net

No comments:

Post a Comment