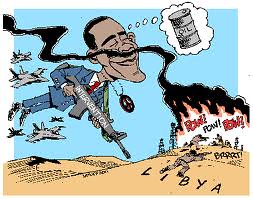

The U.S. imperialists are attacking the North African state of Libya in order to seize the oil-rich country and establish a military beachhead inside the region. Thousands have died in the imperialist war., a photo by Pan-African News Wire File Photos on Flickr.

Voters blame president for gas prices, but experts disagree

How much does the president have to do with the price of gasoline? A lot, American voters say. According to oil experts and economists, not so much — at least in the short term.

By Steven Mufson

The Washington Post

WASHINGTON — How much does the president have to do with the price of gasoline?

A lot, American voters say. According to oil experts and economists, not so much — at least in the short term.

Today's oil prices are the product of years and decades of exploration, automobile design and ingrained-consumer habits combined with political events in places such as Sudan and Libya, anxiety about possible conflict with Iran, and the energy aftershocks of last year's earthquake in Japan.

"This notion that a politician can wave a magic wand and impact the 90-million-barrel-a-day global-oil market is preposterous," said Paul Bledsoe, strategic adviser to the Bipartisan Policy Center and a former Clinton administration official.

The price of gasoline is a hardy perennial in presidential campaigns. President Carter struggled with high gas prices, which had doubled since the Iranian revolution.

What can the president control?

Republicans are saying President Obama has not done enough to promote domestic drilling, but the U.S. drilling-rig count is twice as high as it was in 2009.

With the exception of a spike in 2008, the rig count is higher now than any year since the early 1980s, according to WTRG Economics.

"Everyone takes credit for what's on their watch," said Frank Verrastro, director of the energy program at the Center for Strategic and International Studies (CSIS).

U.S. policy makes a difference, energy experts say, but with a long delay, whether it is a matter of drilling for more oil or increasing the fuel efficiency of the automobile fleet, which takes a decade or more to turn over.

"There is a substantial time lag between the adoption of energy policies (on the demand and supply sides) and their impact on the market," said Jay Hakes, a former administrator of the Energy Information Administration and now director of the Jimmy Carter Library and Museum.

"George W. Bush deserves some credit for signing the 2007 legislation that has helped the current situation from getting worse, but (he) will never get any credit."

Hakes said, "Obama is on a good path to ease future markets." He cites the president's decisions to open new areas for exploration and development, most notably Alaska's Arctic coasts, and to deal aggressively with oil demand by raising efficiency standards for automobiles.

That hasn't stopped Republican leaders — and voters — from blaming Obama for pump prices that have climbed to $3.80 for a gallon of regular gasoline, according to AAA.

Even if voters didn't blame Obama directly for the increase, a slower economy still might hurt his re-election prospects.

Perhaps no politician has done more to put the onus on the president than Newt Gingrich, who says he has a plan to reduce gas prices to $2.50 a gallon and offset the loss of output that might result from an attack on Iran, which exports about 2.5 million barrels of crude a day.

"There's no way we could increase production that much," said Verrastro of the CSIS. "But the facts be damned. It's election season."

The international-oil market has tightened, not because of a single factor, such as U.S. drilling, but because a series of crises has shaved oil production or boosted demand worldwide. Together, they add up to a difference of about 1 million barrels a day in the global-oil balance.

In the wake of a tsunami and earthquake last year, Japan closed down 52 of its 54 nuclear-power plants and has been burning more oil to generate electricity.

In Sudan, bickering between the north and the south and a dispute over pipeline revenue have choked off about 240,000 barrels a day, the International Energy Agency (IEA) said.

Unrest in Yemen and Syria knocked out about 100,000 barrels a day each. Libya's output is recovering from last year's civil war, but at 1.3 million barrels a day, output still is about 300,000 barrels a day short of capacity, traders say. And as a result of maintenance problems in the North Sea, Norwegian and British output is running about 160,000 barrels a day lower than normal, the IEA added.

In China, economic growth has slowed, but the IEA still expects demand to climb by 400,000 barrels a day.

Global-oil demand will hit 89.9 million barrels a day this year, the IEA says, shrinking the spare production capacity to a level lower than Iran's exports.

One thing a president can do is to release oil from the Strategic Petroleum Reserve (SPR). That has happened three times — at the outset of Operation Desert Storm in 1991, after Hurricane Katrina swept through oil production and refining facilities in the Gulf states in 2005, and during the Libyan civil war in 2011. President Clinton ordered a swap of oil from the reserve in 2000, letting refiners give the oil back in 2001.

But oil experts are divided about the impact of such a release. SPR releases have lowered prices in the past, but only temporarily. Moreover, the 696-million-barrel reserve — which could, for example, offset a 280-day suspension of Iranian oil exports — is an emergency stockpile for supply disruptions, not a device for blunting price increases.

Other issues have been raised that have little or nothing to do with current gas prices. Approving the Keystone XL pipeline, rejected by Obama with its current route, would not add to oil supplies; it would only add to the excess-pipeline capacity from Canada that is expected to last until 2016.

Renewable energy such as wind and solar makes the electricity grid cleaner but has nothing to do with oil prices. Electric cars could help, but their sales figures likely will fall short of administration goals. And higher U.S. production will cut U.S. oil imports and ease the pressure on global demand, but the United States will remain a major oil importer for many years.

Washington Post researcher Lucy Shackelford contributed to this report.

Senate rejects refuge opening

WASHINGTON — The Senate on Tuesday resoundingly rejected a sweeping measure to open the Arctic National Wildlife Refuge (ANWR) and other protected areas to oil drilling, as well as to approve construction of the Keystone pipeline project.

Tuesday's vote was the first time in four years that the Senate has voted on a measure including ANWR drilling, and it failed miserably. The proposal needed 60 votes to pass; it only received 41 votes in favor, with 57 senators against.

McClatchy Newspapers

No comments:

Post a Comment