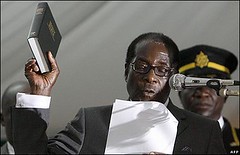

President Robert Mugabe of Zimbabwe being sworn in for a sixth term after a landslide victory over the western-backed opposition MDC-T party on June 27, 2008. The ceremony was held on June 29, 2008 in Harare.

Originally uploaded by Pan-African News Wire File Photos

Herald Reporter

PRESIDENT Mugabe will, this afternoon, swear in 25 ministers of State and deputy ministers at State House in Harare.

In a statement yesterday, the Chief Secretary to the President and Cabinet, Dr Misheck Sibanda, requested those listed below to report at State House by 12 noon today.

Those invited are Cde John Nkomo, Mrs Sekai Holland, Mr Gibson Sibanda, Cde Flora Bhuka, Cde Sylvester Nguni, Mr Moses Mzila Ndlovu, Mr Lutho Addington Tapela, Cde Douglas Mombeshora, Cde Tracy Mutinhiri, Cde Lazarus Dokora, Cde Samuel Undenge, Cde Hubert Nyanhongo, Cde Walter Chidhakwa, Cde Mike Bimha, Cde Reuben Marumahoko, Mr Aguy Georgias, Cde Andrew Langa, Mr Sessel Zvidzai, Dr Tichaona Mudzingwa, Mr Murisi Zwizwai, Mr Jameson Timba, Mr Thamsanqa Mahlangu, Ms Evelyn Masaiti, Ms Jessie Majome and Mr Roy Bennett.

The announcement follows a meeting between President Mugabe, Prime Minister Morgan Tsvangirai and Deputy Prime Minister Arthur Mutambara to discuss the appointments.

In an interview yesterday, Joint Monitoring and Implementation Committee chairperson for February Professor Welshman Ncube confirmed the principals’ meeting, which discussed various issues including the appointments of Ministers of State and deputy ministers.

"The principals also had a meeting with members of JOMIC but details of the meeting would be released in due course," he said.

Prof Ncube said the parties were trying to find a solution to the issue of people arrested for allegedly recruiting Zimbabweans for military training and acts of violence.

Prof Ncube, who co-chairs JOMIC with Cde Nicholas Goche (Zanu-PF) and Mr Elton Mangoma of MDC-T, also distanced the committee from a flier being distributed in and around Harare.

A flier, entitled "Zimbabwe Is Our Zimbabwe", has been circulating in some parts of the country. The flier purports to emanate from JOMIC.

"We wish to advise the public that, this flier does not emanate from JOMIC. We have no knowledge who the authors and distributors are. We wish to distance ourselves as JOMIC from both the content and the principles behind this flier," said Prof Ncube.

The flier gives contact details of JOMIC members. JOMIC monitors the implementation of the broad-based agreement that gave birth to the inclusive Government.

Meanwhile, Prime Minister Tsvangirai and his deputies Prof Mutambara and Ms Thokozani Khupe continued meeting with ministers yesterday.

Change forex vouchers into cash, banks told

Herald Reporter

BANKS have been directed to convert their clients’ savings accounts into foreign currency accounts and encash foreign currency vouchers issued to civil servants as allowances.

Finance Minister Mr Tendai Biti yesterday told a Press conference in Harare that the voucher payment system was inflexible and limited choices available to recipients.

"With immediate effect, all vouchers issued to civil servants as payment of allowances will be redeemable into cash at designed banks," Mr Biti said.

He said the voucher payment system would be scrapped beginning next month.

"With effect from March 2009, payment of allowances to civil servants will be made directly into their respective foreign currency accounts and, therefore, the voucher payment scheme will cease forthwith," he said.

Mr Biti said some civil servants such as soldiers started redeeming their vouchers into cash on Tuesday.

He said by close of business yesterday, teachers and other civil servants would have redeemed their vouchers into cash.

"It is not a hope, we will do that. By close of business today (yesterday) we will pay them. It (the voucher) is 100 percent redemption," Mr Biti said.

The vouchers are worth US$100, but the minister would not divulge the source of the funds only saying "takakiya-kiya"(we managed to do what the situation required).

Mr Biti said the Bankers’ Association of Zimbabwe was also putting in place arrangements to open parallel FCAs to the already existing Zimbabwe dollar accounts.

"Civil servants will, therefore, be able to make cash withdrawals from their foreign currency accounts following deposit of a voucher," he said. He said the development was not a licence for businesses to increase prices.

"Government would like to reiterate that payment of allowances in foreign currency to civil servants is not a licence for unleashing unjustified price increases not related to economic fundamentals and hence inflationary," he said.

Mr Biti observed that in the past inflation was being driven by expectations associated with the weakening of the Zimbabwe dollar.

"Now that the country has embraced the use of multiple currencies which are relatively stable, Government expects all businesses to act responsibly on pricing of goods and services in order to create the necessary confidence in the economy," he said.

Mr Biti said the Government also had an obligation to address the welfare of its former workers, State pensioners.

"Accordingly, Government will be making an announcement on payments of these pensions in foreign currency within the next one to two weeks."

Mr Biti challenged the private sector to emulate Government to avoid disparities in the economy.

The Minister of Media, Information and Publicity, Cde Webster Shamu, also attended the Press conference.

Trading on ZSE resumes today

Business Editor

TRADING resumes on the Zimbabwe Stock Exchange today following almost three months of inactivity as authorities sought to plug loopholes that sent the market wild in the latter part of last year.

Chairperson of the Securities Commission Mrs Willia Bonyongwe confirmed last night that the decision had been reached after consultations with the Ministry of Finance, stockbrokers and other stakeholders.

From today, shares would be traded in foreign currency, with transactions expected to be handled largely through foreign currency accounts.

The bourse suspended trading last November largely due to price manipulation and the issuance of unfunded bank cheques as punters, in connivance with stockbrokers, sought to make the most in an economy largely driven by speculation at the time.

The unfunded cheques had a contagion effect on several stockbroking firms.

Investors, caught up in the web, were crying foul over their investments, which were lying dormant at a time when they needed the returns.

In an interview, Mrs Bonyongwe said more stringent operational guidelines would be enforced to avoid a repeat of the situation that threatened the survival of a critical savings mobilisation avenue in the economy.

"We have really tightened compliance issues. Most of the regulations are already in existence. It’s just that they were not being enforced."

According to estimates by some stockbrokers, given the last closing price, Old Mutual was likely to resume trading at about 115 cents, Delta at 56 cents, Kingdom Meikles Africa would fetch about 105 cents while ABC was likely to sell at 28 cents per share.

Mrs Bonyongwe said all outstanding payments for previous deals were finalised last month, allowing the bourse to start trading on a clean slate.

In a scam unearthed by the Reserve Bank, cheques amounting to sextillions of dollars were issued as bank officials connived with stockbrokers in one of the worst scandals to hit the economy in recent years.

This happened at a time when the total money in circulation was around $10 trillion.

As a result, during the clean-up process, some cheques were rerouted to the RTGS system as the Securities Commission sought to ensure that all payments were settled before resumption of business.

"We could have reopened earlier, but when we were ready brokers said we needed to trade in foreign currency following the partial dollarisation of the economy so we had to engage stockbrokers to research on how other stock exchanges were operating.

"The market has been waiting for the reopening and I think they will be excited that it has finally happened. As the Securities Commission, we want to emphasise the need to fully comply with set regulations.

"We also advise investors to hold on to their shares until the market stabilises so that they will not lose out. People should not be euphoric about it," cautioned Mrs Bonyongwe.

Sadc, Comesa merger poses no threat to revenue earnings

New Ziana

The impending transformation of the Sadc and Common Market for Eastern and Southern Africa into customs unions poses no serious threat to Zimbabwe’s revenue earnings, an official said on Tuesday.

A senior Zimbabwe Revenue Authority official said although integration would reduce earnings from customs duty, increased economic activity would enable the Government to earn more from corporate and Value Added Tax.

Regional integration would eventually result in the zero rating of products, allowing free entry of imports into all countries participating in the customs unions.

Various stakeholders have expressed concern on the threat this poses to the country’s revenue earnings.

"When we open up the market, we are allowing economic activity to increase and when we allow activity to increase, we are creating sources of additional revenue for Government," he said.Comesa plans to launch its customs union this year while that of Sadc is expected next year.

"When one door is closed, another is opened," said the official, adding that Government had already carried out an impact assessment on revenue earnings before accenting to participation in the trading blocs. Sadc and Comesa are currently operating Free Trade Area regimes, which allow goods produced in participating countries to be traded without payment of customs duty.

Each member state, however, maintains its own external tariffs on non-members.

Customs Unions are a level deeper than FTAs.

Countries adopt a common external tariff and are governed by the same legislation dealing with issues such as unfair trading practices, competition and investment. — New Ziana.

‘SA mining firms keen to invest in Zim’

New Ziana.

AN official of the Zimbabwe Miners’ Federation has disclosed that numerous South African companies have expressed interest to invest in Zimbabwe’s mining industry.

In an interview yesterday, ZMF chief executive officer Mr Wellington Takavarasha said the offers of investment were made at the just-ended Mining Indaba in South Africa, which ran from February 9 to 12.

He said the companies had offered to partner local miners in explorations and resuscitation of the industry.

"We cannot at this stage disclose the names of the South African companies since we are still in negotiations, but several companies expressed interest in working with us," he said.

The mining industry has been on a downward trend for the past decade owing to a myriad of problems that include scarcity of foreign currency and high production costs.

Mr Takavarasha said the federation would assist local miners to forge linkages with foreign investors.

"We plan to link miners and foreign investors through a contract system in order to create a transparent working relationship," he said. Mr Takavarasha said other exhibiting companies from overseas had promised to supply the industry with machinery.

"We have foreign companies who have assured us of machinery at concessionary rates," he said, pointing out that lack of machinery had had a negative impact on production levels. — New Ziana.

Economic turnaround prospects bright: Biti

Business Editor Victoria Ruzvidzo

FINANCE Minister Mr Tendai Biti is upbeat that the economy will turn the tide soon with modalities currently being finalised on an economic stabilisation package.

A number of initiatives have already been put in place to jumpstart the recovery process, he said.

Modifications would also be made on the 2009 National Budget proposals presented last month by the then Acting Finance Minister, Senator Patrick Chinamasa, but Mr Biti would not be drawn into the specific adjustments.

Three days in office, Mr Biti said his main mission was "to get Zimbabwe ticking again".

"I was very sceptical before, but now I don’t think there is anyone who is as enthusiastic as I am to get the economy ticking again. To borrow (United States President Barack) Obama’s words . . . Yes, we can and yes, we will get Zimbabwe working again," he said in an interview yesterday.

The shift from a lawyer to a finance minister had been smooth.

"What I do now is different from my time as a lawyer which is more of an individualistic job. Here I am now more of a thinker, a team player and a public relations person . . . I am everything."

Although he could not divulge much about the proposed stabilisation measures, he said the next six months would be telling.

His ministry, he said, intended to deal decisively with issues such as boosting production capacity, creating wealth and employment and the provision of key social services such as adequate food.

Efforts would also be targeted towards restoring the education and health sectors.

He stressed that any outstanding political issues would need to be addressed to ensure sustainable economic recovery.

"There are many who think that the current economic challenges are a function of economics alone, but they have to do with politics as well."

Mr Biti said his immediate preoccupation was to ensure the payment of foreign currency allowances to civil servants, a process that began two days ago. "I am excited to say that we are managing to pay our civil servants without any financial assistance from anyone. We will limp along and the good thing is it’s our own limbs (we are using)," he said.

On how Government intended to finance immediate expenses given the lag between policy pronouncements and revenue inflows, Mr Biti could only say: "We will be creative."

Sen Chinamasa announced a US$1,7 billion budget which would be largely financed from tax and duty payments. There would be no room for excessive expenditure.

However, Zimbabwe Revenue Authority commissioner general Mr Gershem Pasi recently said revenue inflows were expected to initially trickle in before the new measures began to yield positive results.

In the meantime, Government would need to meet expenditure obligations such as salaries.

Zimbabwe’s external partners, some of whom have already chipped in with US$200 million as stated in the budget, were also expected to extend their hand to facilitate a smooth take-off of the economy. The demand for financial resources was growing.

"The past three days have really been exciting. I have had requests for such things as tissue rolls, stationery or a ministry asking for US$20 000 or so to buy furniture. It’s a challenge, but I am excited about this job," said Mr Biti.

He commended staff within his ministry which he said was enthusiastic to get the economy going. "To the sceptics I would like to say I used to be sceptical as well but I have since changed . . . We need to make a positive difference."

He did not shed light on his stance on the randification of the economy as proposed by South African President Kgalame Motlanthe or the floatation of the Zimbabwe dollar, stressing that it was still classified information.

On inflation, Mr Biti said the adoption of the multi-currency system by Government had already dealt a blow to the hyper-inflationary pressures.

"Hyper-inflation is now a thing of the past.

"However, businesspeople that have been operating in a hyper-inflationary environment still think the US dollar is the Zimbabwe dollar and have been tempted to raise prices willy-nilly. "They need to change this mindset completely or we will be forced to intervene to induce discipline."

Much of last year was characterised by daily or in some cases twice daily price movements as speculative tendencies gripped the economy.

"If we are creating an environment of sound market operations, we should operate with market disciplines such as supply and demand and not speculative tendencies," he said.

On the role of the Reserve Bank of Zimbabwe, an institution he has criticised heavily over the last few years, Mr Biti said the central bank was a monetary authority while he handled the fiscal side of things.

Prodded on how he would relate to RBZ Governor Dr Gideon Gono, Mr Biti would only say: "I am not here to create controversies. The issue of the RBZ Governor is being handled by our principals."

UN team to visit Zim

Herald Reporter

UNITED Nations Assistant Secretary-General for Humanitarian Affairs Ms Catherine Bragg will lead a five-member team of high-ranking UN officials to Zimbabwe at the weekend to assess the humanitarian situation.

Ms Bragg, who is also Deputy Emergency Relief Co-ordinator in the UN Office for the Coordination of Humanitarian Affairs, and her team will be in Zimbabwe between February 21 and 25.

She will be accompanied by World Health Organisation Director for Recovery and Transition Programmes Dr Daniel Lopez Acuna, World Food Programme Deputy Regional Representative Mr Timo Pakkala, United Nations Children’s Fund Senior Health Advisor (Emergencies) Mr Robin Nandy and Senior Water, Sanitation and Hygiene Advisor (Emergencies) Mr Andrew Colin Parker.

In a statement, the joint UN humanitarian mission said the team is set to have meetings with senior Government officials, the UN Country Team, the donor community, and representatives of non-governmental organisations.

The team is also scheduled to visit humanitarian projects in the country.

The team will present its findings at the end of the mission.

The humanitarian mission follows a meeting between President Mugabe and UN Secretary General Mr Ban Ki-moon on the sidelines of the 12th Ordinary Session of the African Union Assembly of Heads of State and Government held in Addis Ababa, Ethiopia, recently.

This year alone, the UN has contributed US$18,8 million in humanitarian aid to Zimbabwe.

Zimbabwe is facing a number of challenges, among them the cholera outbreak and shortages of essential drugs and food.

No comments:

Post a Comment