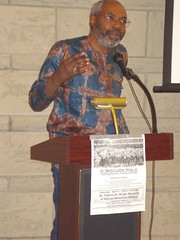

Abayomi Azikiwe, editor of the Pan-African News Wire, speaking at the Dr. Charles H. Wright Museum of African American History on April 5, 2008. The event commemorated the 40th anniversary of the assassination of Dr. Martin Luther King, Jr.

Originally uploaded by Pan-African News Wire File Photos

World leaders oppose financial maneuvers that enrich the ruling class

By Abayomi Azikiwe

Editor, Pan-African News Wire

A recent decision by the Federal Reserve to provide the bankers another $600 billion in bailout funds demonstrates the continuing failure of the government, even under the Democratic Party leadership, to provide any relief for working people and the oppressed. Not only has this announcement that was made during the same week as the midterm elections enraged working people in the U.S., states in both Europe and the developing regions have spoken out forcefully against this latest provocation by the financial sector backed-up by the current administration.

This new handout has been condemned by some of the leading states within Africa, Asia and Latin America. In South Africa, the finance minister said the new U.S. financial move would spell ruin in emerging states.

Brazil, China and other states within the so-called G20 have complained about the move which is taking place just ahead of a meeting of the body in Seoul, South Korea, where there was to be a joint agreement on how to proceed in addressing the global financial crisis. The unilateral action by the financial sector in the U.S. illustrates the desperation of the ruling class to maintain the facade of an economic recovery amid continuing high unemployment and increasing rates of poverty.

According to Republic of South Africa Finance Minister Pravin Gordhan, "Developing countries, including South Africa, will bear the the brunt of the U.S. decision to open its flood gates without due consideration of the consequencies for other nations. The move by the USA will force developing nations to take more steps to mitigate the impact of the increased flows into their financial markets." (French Press Agency, Nov. 5)

Gordhan pointed out that "Most of the 600 billion dollars that the Federal Reserve will pump into the USA's economy will find its way into the financial markets of emerging markets countries, where these dollar flows will have the effect of strengthening emerging market currencies."

With the artificial inflating of currencies in the developing states, it will further disadvantage the exports emanating from these nations and escalate their existing crises that have worsened as a result of the world economic downturn.

On Wall Street the $600 billion injection into the banking system has been met with jubilation. The Financial Times of London featured a headline on November 6 saying "Fed light a fire under stock prices: Wall Street trades at its highest since Lehman's fall, but can the rally last." (Financial Times, Weekend Edition, Nov. 6-7)

Another article in the Financial Times by Jack Farchy pointed out that "The Federal Reserve's decision to support the U.S. economy by printing dollars lent precious metals a new lustre in the eyes of investors, propeling gold to a fresh record of nearly $1,400 an ounce."

In addition to the massive supply of liquidity to the U.S. banking system, the Obama administration's treasury secretary announced other proposals to limit current account surpluses and deficits for all states involved in the G20.

The U.S. actions drew a public response from China when the deputy foreign minister Cui Tiankai said that "We believe a discussion about a current account target misses the whole point. If you look at the global economy, there are many issues that merit more attention--for example, the question of quantitative easing." (Financial Times, Nov.6-7)

Even other western capitalist states objected to the new round of U.S. financial policies ahead of the G20 summit. German finance minister Wolfgang Schauble stated that "With all due respect, U.S. policy is clueless. It's not that the Americans haven't pumped enough liquidity into the market. Now to say let's pump more into the market is not going to solve their problems." (Financial Times, Nov. 6-7)

Jobless Recovery Spells Disaster for Workers

Although the stock market has made significant gains in recent weeks and profits are up among the leading capitalist corporations and banks, this notion of an economic recovery has not translated in to real progress in creating employment. The October 2010 monthly jobless report claimed that over 150,000 new positions were created which was larger than the ongoing pessimistic predictions of the leading bourgeois economists.

Yet even the New York Times stressed that there were officially 15 million people out of work in the United States. This rate of unemployment does not account for the 15-20 million other workers who are not counted in the unemployment rate of 9.6 percent and those who are working part-time or less because there is no full-time work available.

The Times on Nov. 6 pointed out that "The jobless rate has not fallen substantially this year, largely because employers have barely added enough workers to absorb the people just entering the labor force. And even if the economy suddenly expands and starts adding 208,000 jobs a month — as it did in its best year this decade — it would still take 12 years to close the gap between the growing number of American workers and the total available jobs, according to the Brookings Institution’s Hamilton Project." (New York Times, Nov. 6)

The injection of $600 billion to the financial sector from the Federal Reserve Bank will not lead to any significant job creation either. Since 2007, central banks throughout the capitalist world have given more than $10 trillion to the banks and multi-national corporations which has only resulted in the loss of tens of million of jobs in the U.S. and Europe and the further impoverishment of workers and the oppressed all over the globe.

This failed policy of bailing out the banks has been most evident in the housing sector where millions of people have been foreclosed and evicted despite the trillions given to the financial institutions. At the same time the overall social wages of workers have declined significantly in the U.S. and throughout the capitalist states.

In the U.S. tens of thousands of educators and public servants have been thrown out of work over the last three years. There have been hundreds of school closings in each state throughout the country and the elimination of academic and sports programs in public schools.

In the recent midterm elections, the capitalist media in collaboration with the two ruling class parties, rigged the vote by not addressing the critical issues facing workers and the oppressed which are jobs, income, healthcare, housing and quality education. The outcome of the elections do not indicate that workers in the U.S. are satisfied with the wars of occupation, high unemployment, underemployment, growing poverty, the loss of pensions and healthcare and the increase in state repression.

What the midterm election results represent is the lack of an effective political organization that genuinely represents the interests of the workers and the oppressed. There is no enthusiasm for the status-quo and absent of an alternative the electorate will not continue to support the capitalist parties that only look out for the economic and political interests of the ruling class.

A political program that advocates the creation of a WPA-style jobs program becomes even more significant in the coming period because the failure of the ruling class parties to create employment exposes their incapacity to represent the millions of people who are in need of immedite relief. There can be no real recovery without the creation of tens of millions of jobs with good wages and benefits.

In addition, there is the pressing need to stabilize the housing sector by demanding an immediate moratorium on foreclosures and evictions, to keep people in their homes and to defy the power of the banks to seize the property of working people while hording cash and defying the right of people to shelter.

The Moratorium NOW! Coalition to Stop Foreclosures, Evictions and Utility Shut-offs based in the state of Michigan, where the economic conditions of working people and the oppressed communities have been most acute, pointed out in a recent leaflet that "This bailout (of the banks) continues even in the face of massive foreclosure fraud by the largest banks which forced J.P. Morgan Chase and GMAC to temporarily suspend foreclosures during October 2010."

This leaflet continues by making the demand that "Instead of the government bailing out the banks by paying off overvalued fradulent loans, the government should allow people to stay in their homes with affordable payments based on the real value of property." (Moratorium NOW! leaflet entitled: "Stop the 'Silent Bailout' to the Banks.'")

No comments:

Post a Comment