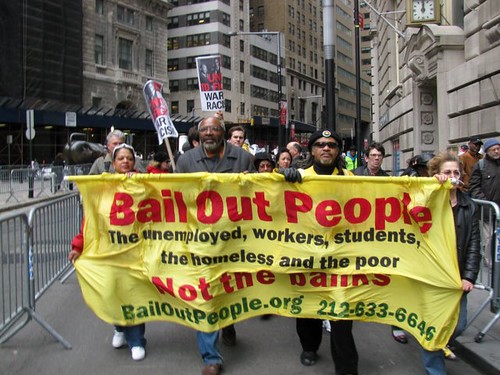

Abayomi Azikiwe, editor of the Pan-African News Wire, covering the April 4, 2009 anti-war march through the financial district in New York City. (Photo: Alan Pollock), a photo by Pan-African News Wire File Photos on Flickr.

AUGUST 8, 2011, 3:46 P.M. ET

Markets Plunge As Recession Fears, S&P Fallout Take Hold

-Stocks and crude oil drop sharply

-Treasurys, gold surge on risk aversion

-Fears of a global slowdown intensify

By Javier E. David

DOW JONES NEWSWIRES

NEW YORK (Dow Jones)--Major U.S. benchmarks and other high-yielding assets plunged Monday, sending safe-haven Treasurys and gold soaring as investors fled the double-barreled impact of recession fears and a credit downgrade of the world's largest economy.

On the heels of a decision by Standard & Poor's to strip the U.S. of its triple-A credit rating, markets around the world reacted dramatically. Oil plunged to a 2011 low below $82 per barrel, and risk-sensitive assets such as the euro skidded lower. Gold--a haven for nervous investors--surged to new record highs.

Europe's own debt travails and a torrent of data suggesting that the world's economy is decelerating sharply have unsettled investors, and left some analysts weighing whether S&P's move could become the tipping point for a global recession.

Investors said that the price moves are reminiscent of the wild swings in 2008. However, the more unsettling question for investors is if--and how--policy makers might slow the bleeding.

"It is [at] the core: our government and Europe and the debt situation," said Davide Accomazzo, chief investment officer at Cervino Capital in Los Angeles. "What scares people is there is no real fundamental blueprint for this."

Despite early predictions that U.S. government paper would lose its status as a shelter for nervous investors, benchmark yields hit their lowest level since January 2009. The 10-year yield, which moves inversely to its price, fell as low as 2.325%, and traded at 2.354% midafternoon, as the price jumped.

The two-year note's yield hit a record low of 0.228%, falling below the top end of zero-0.25%.

The Dow Jones Industrial Average was recently down 392 points, or 3.4%, to 11053. The blue-chip index earlier dropped as much as 605 points before recouping part of the loss. The measure is on track for more steep losses following the worst weekly point decline since late 2008.

The downward spiral in markets put new emphasis on the Federal Reserve's policy-meeting Tuesday.

Virtually no analysts expect the Fed to deviate from its bias for ultra-loose monetary policy, but given the rising anxiety, some analysts will parse the central bank's statement for signs that the Fed may embark on another round of controversial monetary easing.

"There's a fear that there's no leadership in either Washington or the Federal Reserve and no way to bolster the economy," said Tom Pawlicki, a precious metals analyst with brokerage MF Global.

The S&P downgrade was largely telegraphed ahead of time, allowing investors to consider a world where the U.S. was no longer a triple-A country. As a result, Treasurys and the dollar began Monday on a relatively strong note.

Europe, however, is not much better off than the United States, with European officials struggling to contain a raging debt crisis. As a result, the euro was roundly battered by risk aversion, and fears that the European Central Bank's efforts to safeguard Italy and Spain from contagion risks through purchases of their debt would fall short of what analysts believe is necessary.

The euro shed more than two cents from its Asia trading high against the dollar to change hands below $1.42. The dollar set a new record low against the Swiss franc at CHF0.7480 and fell nearly one per cent against the yen to Y77.70, but its losses were limited amid fears of intervention by the monetary authorities of Japan and Switzerland.

Benchmark crude futures fell to their lowest level all year, largely tracking the decline in the equity markets. Light, sweet crude for September delivery settled down $5.57, or 6.4%, at $81.31 a barrel on the New York Mercantile Exchange, its lowest finish since Nov. 23.

The declines reflect fears that a possible second recession due to political deadlock in the U.S. and a worsening sovereign debt crisis in Europe will eventually curtail demand for raw materials.

Gold futures made their largest gains in after-market trading and just moments after the Dow Jones Industrial Average touched the day's lows. The most active contract, for December delivery, was recently at $1,712.20 a troy ounce, up $60.40 or 3.7%, after soaring to an intraday record of $1,723.40.

-By Javier E. David, Dow Jones Newswires; 212-416-4564;

javier.david@dowjones.com

--Steven Russolillo, Min Zeng, Daniel Strumpf, Tatyana Shumsky, Jerry Dicolo contributed to this article.

Bank Stocks Tumble Amid Huge Slump

Bank of America Corp. (BAC) and Citigroup Inc. led U.S. lenders to their steepest drop in more than two years as the government’s loss of its AAA credit rating rippled through financial markets.

Bank of America, the nation’s largest bank by assets, plunged as much as 23 percent and Citigroup slid as much as 22 percent, leading the KBW Bank Index (BKX) down 12 percent. It was the worst showing for the 24-company benchmark since April 20, 2009, when Bank of America told investors it was putting aside more money to cover a growing pool of uncollectible loans.

Those costs have continued to erode investor confidence ever since for the lender and some of its biggest rivals. More pressure came last week after S&P’s downgraded the credit of the U.S. government, which guarantees some of their deposits and debt, to AA+. Bank of America’s shares sold for only a third of their book value during the session, and Citigroup’s price-to- book ratio fell to just under 50 percent.

“Investors are dumping financials because there’s so much confusion about what could be on their books,” Dave Lutz, head of ETF trading and strategy at Stifel Nicolaus & Co. in Baltimore, said in an interview. “You’ve got a perfect storm against Bank of America.”

Bank of America slid $1.46, or 18 percent, to $6.71 as of 2:57 p.m. in New York Stock Exchange composite trading. It was the biggest drop since April 2009, and left the stock shorn of almost half its value since the start of this year. Citigroup fell $5.81 to $27.63 and sold for as little as $26.25, its largest decline since February of 2009.

Default Swaps

Credit-default swaps on Charlotte, North Carolina-based Bank of America soared to the highest since May 2009, as prices on contracts for U.S. banks including Morgan Stanley and Citigroup rose, according to data provider CMA. Bank of America’s contracts gained 98 basis points to 306 basis points as of 3:02 p.m.

The downgrade led to cuts in credit ratings at companies sponsored or backed by the U.S., including Fannie Mae and Freddie Mac, the two mortgage finance firms seized by the government in 2008 to prevent their collapse. Both were lowered to AA+ because of their “direct reliance on the U.S. government,” the ratings firm said.

Stocks React

Among other U.S. lenders, New York-based JPMorgan Chase & Co. fell 8.1 percent, San Francisco-based Wells Fargo & Co. dropped 6.6 percent and U.S. Bancorp declined 7.7 percent. Goldman Sachs Group Inc. declined 8 percent and Morgan Stanley dropped more than 15 percent. Capital One Financial Corp., Regions Financial Corp. and SunTrust Banks Inc. all lost more than 12 percent.

Before trading began, American International Group Inc. disclosed plans to sue Bank of America over faulty mortgages and analysts speculated the bank may need to raise capital.

AIG, the insurer rescued by U.S. bailouts during the 2008 financial crisis, contends Bank of America caused more than $10 billion in losses at the company, which had specialized in investments and insurance tied to mortgage bonds. Bank of America, which repaid its own government bailout in 2009, rejected the assertions of New York-based AIG.

The suit is the latest legal pressure faced by Brian Moynihan, 51, who took over as chief executive officer at the bank last year. Last month, former investors including BlackRock Inc. sued Bank of America after opting out of a $624 million settlement tied to loans made by Countrywide Financial Corp., which the bank now owns. Plaintiffs said the subprime lender misled shareholders about its finances and lending practices.

Economic Outlook

Bank of America shares have been dogged by concerns that mortgage expenses and a stagnating U.S. economy will crimp profit and force it to bolster capital by selling new shares. Moynihan has repeatedly said this year that the firm won’t need to issue common stock.

“The bias that exists, and that is gaining credibility, is that a double dip is ahead of us,” said Charles Peabody, an analyst at Portales Partners LLC in New York. “If that’s the case, then something like Bank of America is going to have to raise substantial equity externally.”

Mike Mayo, the Credit Agricole Securities USA analyst who said July 20 he didn’t foresee the need to raise funds, downgraded the stock today to “underperform” from “outperform” and said investors “can no longer rule out a capital raise.” Keith Horowitz at Citigroup reiterated his buy recommendation, saying there’s “significant value here” and that Bank of America doesn’t need to raise capital.

Capital Debate

“Even as we have been building our reserves, we have improved our capital levels and our liquidity,” the bank said in a memo distributed to employees and dated Aug. 7. “Our tangible common equity ratio -- the most basic measure of capital strength -- has risen to 5.87 percent on June 30, 2011, from 5.05 percent on December 31, 2009, higher than JPMorgan Chase.”

As for the AIG case, the bank rejects the insurer’s “assertions and allegations,” said Larry DiRita, a spokesman for the lender, the biggest in the U.S. by assets.

“AIG recklessly chased high yields and profits throughout the mortgage and structured finance markets,” DiRita said. “It is the very definition of an informed, seasoned investor, with losses solely attributable to its own excesses and errors.”

To contact the reporter on this story: Hugh Son in New York at hson1@bloomberg.net

To contact the editor responsible for this story: David Scheer at dscheer@bloomberg.net

Last updated: August 8, 2011 10:04 pm

Global investors run from equities

By Richard Milne in London and Telis Demos in New York

Financial Times

US shares tumbled in their biggest falls since the peak of the financial crisis as a global growth scare caused investors to shun equities and take refuge in government debt.

Bank of America fell as much as 23 per cent, Citigroup 22 per cent and Morgan Stanley 15 per cent as the first trading day following Standard & Poor’s downgrade of the US credit rating saw a rout in markets with the S&P 500 closing down 6.6 per cent, its biggest one-day fall since December 2008.

Germany’s Dax-30 and France’s CAC-40 became some of the first big western stock markets to enter “bear” territory, after falling more than 20 per cent from their peaks.

The plunge in markets came after the European Central Bank bought billions of euros of Italian and Spanish debt , causing their borrowing costs to drop sharply but giving little relief elsewhere. French credit default swap prices, a form of investor protection, rose to a record high as investors continued to fret over the eurozone debt crisis.

Barack Obama, US president, also failed to calm markets, saying the US was downgraded not because S&P doubted the nation’s ability to pay its debt, but the political system’s ability to act. “No matter what some agency may say, we’ve always been and always will be a triple A-country,” he said.

Despite the downgrade,US government debt was one of the big beneficiaries of the sell-off . Its benchmark 10-year bond yields fell 24 basis points to 2.32 per cent, their lowest since January 2009. Two-year yields hit a record low of 0.23 per cent.

“The US economy needs near-term fiscal stimulus and credible, medium-term fiscal tightening. It has neither,” said Sushil Wadhwani, founder of the eponymous hedge fund and a former member of the Bank of England’s interest rate-setting committee. “This should undermine risk assets and global growth.”

Jim Leaviss of M&G, one of Europe’s largest bond investors, called the downgrade “an end of empire moment”.

The Dax closed down 5 per cent, the CAC was off 4.7 per cent and the FTSE 100 in London fell 3.4 per cent. The S&P 500 was down 5.6 per cent in afternoon trading, its worse fall since December 2008.

The ECB bond purchases, estimated by investors at about €2bn, brought some relief. The 10-year yields for Italy, the world’s third-largest bond market, fell 81bp to 5.35 per cent while those for Spain sunk 105bp to 5.22 per cent.

Andrew Balls, head of European investment at Pimco, the world’s second-largest bond investor, said: “The ECB is doing this via its balance sheet: it is sensible, bold and overdue. But I think some permanent damage has been done to risk.”

The euro fell 1.3 per cent against the dollar, with some blaming the fall on the spike in French CDS and a worry about whether Paris can maintain its triple-A credit rating. German CDS came close to highs only seen once before in early February and March 2009, although its 10-year yields dropped 9bp to 2.28 per cent, their lowest in a year.

“Europe is still the real danger,” said Steve Wood, chief market strategist at Russell Investments.

“The US downgrade is about long-term political will, whereas in Europe there are immediate risks, it’s today.”

Greece became one of the first markets to impose a ban on short-selling, starting from Tuesday, a common tactic from the 2008 financial crisis.

Additional reporting by Stephanie Kirchgaessner in Washington

August 8, 2011 7:43 pm

Fannie Mae and Freddie Mac downgraded

By Johanna Kassel and Aline van Duyn in New York

Financial Times

Standard & Poor’s on Monday cut the triple A credit rating of government-backed mortgage financiers Fannie Mae and Freddie Mac following a similar downgrade of the US government on Friday.

The move, which was flagged by S&P on Friday when it cut the US rating from triple A to double A plus, highlights the extent to which the US mortgage finance industry is propped up by the US government.

Fannie Mae and Freddie Mac were placed into conservatorship during the financial crisis and rely on the US government for funding.

“The downgrades of Fannie Mae and Freddie Mac reflect their direct reliance on the US government,” said S&P in a statement. “In addition to the implicit support we factor into our ratings, the US Treasury has demonstrated explicit support by providing these entities with capital quarterly, as necessary.”

Standard & Poor’s also lowered its ratings for 10 of 12 Federal Home Loan Banks to double A plus.

The rating agency also lowered its ratings of clearing houses that form a crucial role in providing the plumbing for the financial system and which will be more important as derivatives are shifted on to clearing platforms.

The Depository Trust Co, National Securities Clearing Corp, Fixed Income Clearing Corp and Options Clearing Corp were all downgraded from triple A to double A plus.

S&P is also expected to downgrade some municipalities and states.

The longer-term impact of such a broad loss in triple A ratings is still unclear, investors said. Already on Monday, investors were selling risky assets and moving into safer havens. US Treasury debt rallied strongly as a result.

“There is a lot left unsaid by S&P,” said Peter Fisher at BlackRock, who was eager to hear the consequences for related credit ratings on debt issued by the government-sponsored agencies and municipalities. He expects short-term volatility.

“There are those investors who want to take risk off, either directly or indirectly,” Mr Fisher said.

Additional reporting by Dan McCrum in New York

http://blogs.ft.com/beyond-brics/2011/08/08/china-and-us-debt-a-sanctimonious-drug-dealer/#ixzz1UTSnaW3M

China and US debt: a sanctimonious drug dealer

August 8, 2011 9:29 am

by Simon Rabinovitch

Financial Times

Seeing China’s invective-laden rant about US debt over the weekend, it was easy to forget that Beijing deserves at least part of the blame for Washington’s fiscal mess.

It is hard to argue with China’s view that the US has been addicted to borrowing and living beyond its means. But the addict wouldn’t have been so hooked without a generous dealer. China has been the main supplier of the cheap debt that the US has found to be such an irresistible drug.

The problem is not just that China is the biggest foreign holder of US Treasuries with more than $1,100bn. Even more concerning is the rate of increase of China’s holdings, from less than $100bn a decade ago to the vast and unprecedented pile it has amassed today.

That increase has made China the most important buyer of US debt over the past decade. It was knocked off its throne only briefly when the Federal Reserve stepped in to buy government bonds with its quantitative easing programme.

China’s largesse did not cause the global financial crisis – it did not cause US regulators to overlook dangers in the subprime mortgage market. But it did act as a facilitator, enabling the US to enjoy the ultra-low interest rates for a prolonged period of time that encouraged all kinds of crazy risk-taking.

Xinhua, China’s state-run news agency, began its fiery commentary on Saturday with this line: “The days when the debt-ridden Uncle Sam could leisurely squander unlimited overseas borrowing appeared to be numbered”.

Apart from the fact that such snarkiness hardly befits the official news agency of the world’s second-largest economy, Xinhua was hypocritical to raise the issue of “unlimited overseas borrowing” without even questioning China’s own hand in the vicious debt cycle.

China’s bottomless appetite for US debt is a direct result of its own distorted currency regime, whereby it buys much of the foreign exchange streaming into the country in order to hold down the value of the renminbi and, in turn, invests that foreign cash in US government bonds.

This point has been made many times before, but it bears repeating that a more market-driven renminbi would have produced a different outcome: China’s forex reserves would certainly have grown more slowly and it is conceivable that the US trade deficit would have been smaller. The world economy would still have had problems aplenty, but it would have been on somewhat more stable footing.

On a hopeful note, one constructive thing to come from the US rating downgrade could be a stronger conviction inside China that faster exchange rate reform is needed.

Xia Bin, an academic adviser to the Chinese central bank, said as much on his micro-blog, arguing that Beijing has no choice but to internationalise its currency.

The central bank got off to a promising start on Monday, raising its daily fixing for the renminbi by the most in nearly a year and letting its exchange rate climb to a record high against the dollar.

Is the world’s biggest debt dealer finally cleaning up its act?

No comments:

Post a Comment