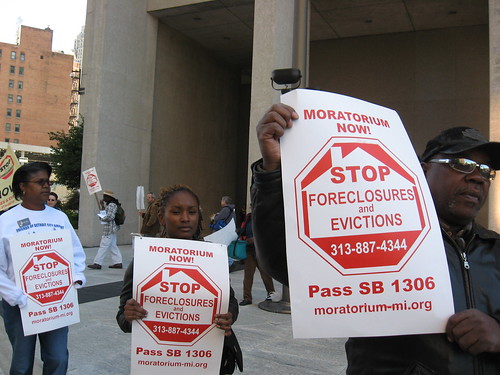

Moratorium Now! Coalition to Stop Foreclosures and Evictions held a demonstration outside the federal bldg. in downtown Detroit on Oct. 3, 2008. (Photo: Alan Pollock)., a photo by Pan-African News Wire File Photos on Flickr.

AUGUST 1, 2011, 4:55 P.M. ET

US Stocks Fall In Volatile Session; DJIA Has 7th Straight Loss

--DJIA posts first seven-session slide since July 2010

--Weak manufacturing data erased early rally

--Worries over further U.S. debt problems add to cautious sentiment

--Health-care stocks hit by Medicare payment cut

By Brendan Conway

Of DOW JONES NEWSWIRES

NEW YORK (Dow Jones)--U.S. stocks fell but finished above session lows, as weak manufacturing data and worries of potential downgrades to the U.S. credit rating overpowered investor relief over the weekend's debt-ceiling deal.

The Dow Jones Industrial Average shed 10.75 points, or 0.09%, to 12132.49, for its seventh-straight losing session, the longest losing streak in more than a year. It was a volatile session that saw the Dow briefly fall below 12000 for the first time since late June. The blue-chip index had risen as much as 139.18 points immediately after the open, as investors expressed relief at the compromise hammered out late Sunday to raise the U.S. debt ceiling.

But stocks turned negative after a reading on manufacturing in July showed barely any growth, renewing worries about the health of the U.S. economy. The Dow fell by as much as 145.16 points midsession.

The action followed the index's biggest weekly point swoon since May 2010, which came last week as investors fretted that Washington had run out of time to raise the debt ceiling and stave off a potential default.

The Standard & Poor's 500-stock index lost 5.34 points, or 0.41%, to 1286.94, for the sixth straight decline. All sectors except utilities and telecommunications lost ground. The Nasdaq Composite shed 11.77 points, or 0.43%, to 2744.61, its fifth drop in the last six sessions.

The weak manufacturing data sat uneasily with investors who have been expecting stronger growth in the second half. Meanwhile, markets continued to eye the chance of a U.S. credit-rating downgrade, which many investors considered to be possible despite the weekend debt pact.

"Wall Street doesn't work well with this kind of uncertainty," whether in the form of weak economic data or the state of the U.S. debt negotiations, said Alan Valdes, director of floor trading at DME Securities.

Health-care stocks were the S&P 500's weakest performers after the Centers for Medicare & Medicaid Services said it will cut payment rates to skilled nursing facilities by 11.1% next fiscal year. Health-care provider stocks tumbled.

Sun Healthcare Group plunged $3.65, or 52%, to 3.35, while Skilled Healthcare Group dropped 3.74, or 43%, to 5.06. Kindred Healthcare slumped 5.51, or 29%, to 13.33, while Sunrise Senior Living lost 26 cents, or 3%, to 8.56.

Merck eased 69 cents, or 2%, to 33.44, and Home Depot shed 68 cents, or 2%, to 34.25, leading blue-chip decliners.

In corporate news, Paetec Holding jumped 91 cents, or 21%, to 5.33, after rural telecom company Windstream said it planned an $891 million all-stock purchase of the company, which provides broadband and other services to businesses. Windstream's shares lost 6 cents, or 0.5%, to 12.15.

U.S.-listed shares of HSBC Holdings rose 79 cents, or 1.6%, to 49.66, after the bank reported revenue for the first half of the year that exceeded estimates and said it was cutting about 30,000 jobs to revamp its global business.

Allstate picked up 62 cents, or 2.2%, to 28.34. The insurer swung to a second-quarter loss after a series of severe storms during the spring. But results beat analysts' expectations.

Old National Bancorp added 74 cents, or 7.3%, to 10.94. The bank's second-quarter net income increased, its net interest margin improved and its credit remained "well controlled," according to the company.

Talbots jumped 61 cents, or 18%, to 4.07, after a securities filing showed that private-equity firm Sycamore Partners took a 9.9% stake in the women's clothing retailer.

Louisiana-Pacific dropped 49 cents, or 6.3%, to 7.26. The construction-materials company swung to a second-quarter loss, struggling as a result of slowing retail sales and lower housing starts.

Haemonetics fell 7.14, or 11%, to 58.36. The medical-device company's quarterly earnings fell short of analysts' expectations, hurt by the recall of its OrthoPAT devices. The company said it expects the recall to continue to present a headwind for the remainder of the fiscal year.

Sourcefire advanced 54 cents, or 2.2%, to 25.12 after Morgan Stanley analysts upgraded their stock-investment rating on the cybersecurity company, predicting a third-quarter pickup in federal business.

-By Brendan Conway, Dow Jones Newswires; 212-416-2670; brendan.conway@dowjones.com

No comments:

Post a Comment