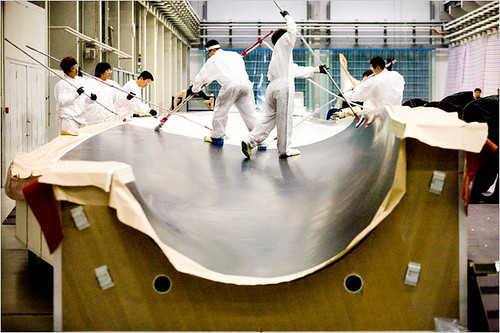

Chinese produced wind turbines illustrate the vanguard role of the socialist state in producing clean energy. The U.S. will eventually be dependent on this Asian nation for this advanced technology., a photo by Pan-African News Wire File Photos on Flickr.

China Manufacturing Gain Shows Momentum in Asia

By Bloomberg News on February 29, 2012

China’s manufacturing improved for a third straight month in February, signaling the world’s second- biggest economy is maintaining momentum amid Europe’s debt crisis and a cooling domestic property market.

The purchasing managers’ index rose to 51.0 from 50.5 in January, China’s statistics bureau and logistics federation said in a statement today. The level, above the expansion-contraction dividing line of 50, was the highest since September and compares with the 50.9 median estimate in a Bloomberg News survey. Economic data in the first two months are distorted by the weeklong Chinese New Year holiday.

Today’s data, along with a surprise gain in Japanese companies’ capital spending and South Korea’s biggest increase in exports in six months, add to signs that global growth prospects are improving as the U.S. recovery strengthens and Europe works to contain its debt crisis. Asia’s benchmark index entered a bull market yesterday, led by gains in China Shipping Container Lines Co.

The report supports the view that “pent-up demand will produce an export-led bounce in Asian economic activity” now that Europe’s debt turmoil is receding, said Tim Condon, chief Asia economist at ING Financial Markets in Singapore, which accurately forecast today’s result.

HSBC Gauge

A separate manufacturing index released today by HSBC Holdings Plc and Markit Economics rose to 49.6 in February from 48.8 the prior month, the third straight improvement and the highest since October.

The fourth-quarter slowdown in exports was probably “transitory” and economic-growth forecasts for Asia “are too low,” said Condon, who previously worked at the International Monetary Fund.

Analysts’ estimates for the gauge ranged from 50 to 51.5. The sub-index of new export orders rose to 51.1, the highest since May and above 50 for the first time since September, from 46.9 in January. The gauge of input prices gained to 54, the highest since September, from 50 in January.

China’s Shanghai Composite Index, which gained 5.9 percent in February, today rose 0.1 percent at the 11:30 a.m. local-time break. The benchmark MSCI Asia Pacific Index of stocks dropped 0.6 percent at 1:47 p.m. in Tokyo. The gauge had advanced more than 20 percent from its Oct. 5 low as of yesterday.

The federation’s index is based on a survey of managers at more than 800 companies in 28 industries. The HSBC gauge covers more than 400 businesses.

GDP Slowing

China’s gross domestic product expanded 8.9 percent in the fourth quarter of 2011, slowing from a 9.1 percent gain in the previous three months, as the government waged a campaign to tame gains in consumer and housing prices.

Caterpillar Inc. the world’s biggest maker of construction and mining equipment, said it’s seeing an improvement in the economy.

“China is recovering a little bit and before the end of the year we will see more activity” there, Chief Executive Officer Doug Oberhelman said yesterday in Santiago in comments that were translated from Spanish.

China’s exports and imports fell for the first time in more than two years in January, while new lending was the lowest for a January in five years. Housing prices in January failed to rise in any of 70 cities monitored by the government, a statistics bureau report showed.

New Lending

China’s new loans in February may have been less than 750 billion yuan ($119 billion), the Economic Information Daily, a newspaper owned by the official Xinhua News Agency, reported in today’s edition. The median estimate as of yesterday in a Bloomberg survey of six analysts was for 810 billion yuan. The central bank is due to report the data later this month.

Today’s manufacturing-index report “looks more like a seasonal rebound,” said Yao Wei, a Hong Kong-based economist for Societe Generale SA. “The growth momentum seems to be stabilizing but still vulnerable.”

Australia was an exception today to the economic data in the Asia Pacific region. Business investment unexpectedly fell in the three months through December, while Australian home- building approvals rose by less than economists forecast in January.

Japanese companies’ capital spending excluding software rose 4.9 percent in the fourth quarter from a year earlier, adding to signs that the world’s third-biggest economy is set to return to growth. The gain compared with a median estimate of a 7.4 percent decline in a Bloomberg survey of six economists.

South Korea Exports

South Korea’s overseas shipments rose 22.7 percent in February from a year earlier after falling a revised 7 percent in January. The median estimate in a Bloomberg News survey of 14 economists was for a 16.4 percent increase.

The euro zone’s jobless rate is forecast to remain at 10.4 percent in January, the highest in 14 years, according to the median forecast of 35 economists. Inflation in the region was probably 2.6 percent in February, according to an initial estimate, unchanged from January’s final reading. Both reports are due out later today.

U.S. manufacturing may have accelerated for a fourth month in February. The Institute for Supply Management’s factory index rose to 54.5, the highest since May, from 54.1 in January, according to the median estimate of 78 economists surveyed by Bloomberg News for a report due today.

Initial jobless claims in the U.S. probably rose to 355,000 in the week ended Feb. 25 from a four-year low of 351,000 a week earlier, according to the median projection of 48 economists. Consumer spending may have increased 0.4 percent in January, according to the median of 80 economists, after being little changed in December.

Growth Slowing

In China, slowing overseas sales and Premier Wen Jiabao’s pledge to maintain curbs on the property market may cause growth to drop to 7.5 percent this quarter, according to Nomura Holdings Inc. That would be the least since the global financial crisis.

In contrast, Lu Ting at Bank of America Corp. expects first-quarter expansion of 8.6 percent.

Wen said economic-policy fine-tuning needs to begin this quarter, Xinhua reported on Feb. 12. The central bank cut lenders’ reserve requirements effective Feb. 24, the second reduction in three months, to spur lending and sustain expansion.

Economists combine Chinese data for the first two months to smooth distortions caused by the timing of the weeklong Lunar New Year holiday. The festival fell in January this year and February last year.

--Zheng Lifei. With assistance from Tracy Withers in Wellington, Ailing Tan in Singapore and Regina Tan and Huang Zhe in Beijing. Editors: Scott Lanman, Nerys Avery

To contact Bloomberg News staff for this story: Zheng Lifei in Beijing at lzheng32@bloomberg.net

To contact the editor responsible for this story: Paul Panckhurst at ppanckhurst@bloomberg.net

No comments:

Post a Comment