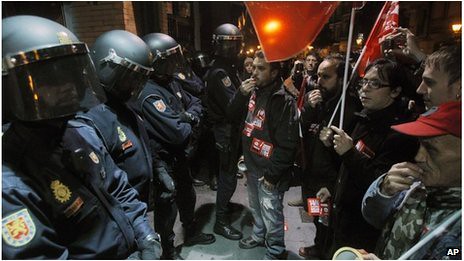

Anti-austerity protests swept several European states including Italy, Greece, Spain and Portugal. The economic crisis of capitalism is worsening throughout the world., a photo by Pan-African News Wire File Photos on Flickr.

Europe Leaders Face Greek Aid Gap in Brinkmanship With IMF

By James G. Neuger - Nov 19, 2012

Bloomberg

European finance ministers will try to plug a 15 billion-euro ($19 billion) hole in Greece’s finances and win over the International Monetary Fund in the latest installment of three years of debt-crisis brinkmanship.

Recycling European Central Bank profits on Greek bonds, charging Greece lower interest rates and extending repayment deadlines are among the options under consideration today for filling the new gap in Greece’s public accounts.

European governments tore open the hole last week, by giving Greece two extra years to cut its budget deficit. The required extra financing provoked a clash with the IMF, since it would add to Greece’s debt load instead of reducing it.

“Greece is in a mess,” James Mirrlees, a Nobel economics laureate, told Bloomberg Television yesterday. Europe won’t solve the problem by “fiddling around with little bits of extra bailout and allowing them to go a bit slower.”

Officials said today’s meeting, starting at 5 p.m. in Brussels, won’t make a final decision to release the next tranche of aid to Greece, partly because parliaments in Germany, the Netherlands and Finland have yet to weigh in.

The “troika” representing creditors also has to certify that Greek Prime Minister Antonis Samaras’s coalition government has delivered economy-boosting steps ranging from improvements to tax collection to the deregulation of closed professions.

The meeting comes a day after France lost its top credit rating with Moody’s Investors Service, increasing pressure on President Francois Hollande to find ways to bolster growth in Europe’s second-largest economy.

Euro Falls

France was cut to Aa1 from Aaa, the rating company said. The Moody’s downgrade follows one by Standard & Poor’s in January.

The euro slid versus most of its 16 major counterparts after the Moody’s action renewed concern the currency bloc’s debt crisis is deepening. The 17-nation euro dropped 0.2 percent to $1.2783 as of 9:29 a.m. in Tokyo, and lost 0.3 percent to 103.99 yen.

Greek bonds gained for a seventh day yesterday amid expectations that creditors will keep money flowing to the Athens government. The yield on 10-year Greek notes fell 25 basis points to 17.22 percent.

One option is to deliver about 44 billion euros to Greece in December, by bundling 31.5 billion euros on hold since mid- year with two other tranches due before year-end, German Finance Minister Wolfgang Schaeuble said after the ministers failed to finalize the financing last week.

Paris Meeting

Finance officials from Germany, France, Spain and Italy met yesterday in Paris to overcome differences. Spokesmen for the four finance ministries declined to comment on the meeting, which was also attended by European Union Economic and Monetary Commissioner Olli Rehn.

Last week’s decision to grant Greece two extra years, to 2014, to cut its deficit to 2 percent of gross domestic product without offering debt relief stirred tensions with the IMF, provider of about a third of 148.6 billion euros in loans funneled to Greece since 2010.

German Chancellor Angela Merkel, gearing up for a campaign for a third term next year, has ruled out writing off a portion of Greece’s debt. Dutch and Finnish leaders have told their bailout-weary voters the same thing.

IMF Managing Director Christine Lagarde, who began the crisis as French finance minister, sparred publicly with the chairman of the euro meeting, Luxembourg Prime Minister Jean- Claude Juncker, over the European inability or refusal to bring down Greece’s debt burden.

“We clearly have different views,” Lagarde said at a joint briefing with Juncker after the Nov. 12 crisis meeting.

Deadline Extended

The trigger was a decision by the ministers to extend by two years, until 2022, a deadline for paring Greece’s debt to 120 percent of GDP. The debt load is set to peak at 190 percent of GDP in 2014, according to the troika, made up of the IMF, European Central Bank and European Commission.

Lagarde, who cut short a trip to southeast Asia to return to Brussels for today’s talks, declined to say whether the IMF would budge on the debt target. In an interview in Manila, she said the IMF’s credibility is at stake in pursuit of “a solid program for Greece that convinces investors today that it will stand tomorrow.”

Plugging the financing gap through 2014 is easier than demonstrating to the IMF that Greek debt is on a glidepath to “sustainability,” officials said. Greece’s loan rates have been lowered and repayment schedules lengthened twice before, and no one has publicly contested doing so again.

Tapping Profits

Finance ministers are also considering how to tap profits made by the ECB and national central banks on Greek bonds, drawing on a February commitment to recycle that money back to Greece. The question of how to treat future ECB profits also has to be addressed.

The central bank is sitting on 208.5 billion euros of bonds of debt-hit governments that it started buying in May 2010 in a controversial program that contributed to the resignation of two Germans from its policy council. While the purchases were halted in March, ECB President Mario Draghi has sketched out a new bond-buying program that would only benefit countries that meet strict conditions.

Asked if unrealized ECB profits on Greek bonds held to maturity could be eventually earmarked for paying off Greek debts, Finnish Finance Minister Jutta Urpilainen said in an interview in Helsinki yesterday: “There are different proposals on the table, of which this is one. We’ll have to see how it looks like as a whole.”

To contact the reporter on this story: James G. Neuger in Brussels at jneuger@bloomberg.net

To contact the editor responsible for this story: James Hertling at jhertling@bloomberg.net

No comments:

Post a Comment