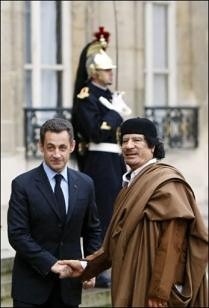

French President Sarkozy and Libyan leader Mummar Gadaffi during the North African head of state's visit to Paris. A deal was sealed involving arms and nuclear energy. France later bombed the country and sent military advisors for regime change., a photo by Pan-African News Wire File Photos on Flickr.

France eyes Libya deals after unfreezing $2 bln assets

4:43pm EST

PARIS, Nov 12 (Reuters) - France said on Monday it was ready to start releasing almost $2 billion in frozen assets belonging to Libya's sovereign wealth fund, as it looks to secure investment from the oil-producing nation.

France's Foreign Minister Laurent Fabius made the announcement during a visit to Tripoli, the latest in a series of high-level French political and business delegations to the OPEC member.

France spearheaded efforts to oust Libyan leader Muammar Gaddafi last year and, as part of wide-ranging international sanctions, froze about $8-9 billion in assets held in France.

"France is committed through me to immediately begin unfreezing the funds of the Libyan Investment Authority estimated at $1.865 billion," Fabius said, according to a copy of a speech to Libya's general congress sent to Reuters by the foreign ministry.

During the visit, Fabius and Industry Minister Arnaud Montebourg were due to discuss Libya's reconstruction and the sovereign wealth fund's interest in taking over a refinery in Normandy owned by insolvent Swiss refiner Petroplus.

The Socialist government of President Francois Hollande is anxious to curry investment from abroad amid high domestic unemployment and a stagnant economy.

The government also hopes to secure a rescue of Petroplus' Petit Couronne plant, the oldest refinery in France that was placed under legal protection after the company filed for insolvency last year.

In an interview published on Sunday in Le Journal du Dimanche, Montebourg said France could co-invest alongside Libya's sovereign wealth fund if the fund takes over the plant that was put under legal protection after its Swiss-based owner Petroplus filed for insolvency last year.

Several potential rescuers have expressed interest in the Petit Couronne refinery, including Hong-Kong-based Alafandi Petroleum Group (APG) and NetOil, a group led by Middle Eastern businessman Roger Tamraz.

Fabius said on Monday Paris had already released another $1.8 billion in other Libyan assets.

The speech did not refer to the other outstanding funds. But Fabius' predecessor, former foreign minister Alain Juppe pledged to help Libyan authorities recoup all their frozen assets.

Last week, the chairman of the Libyan Investment Authority said that a court in Rome had ordered the release of the fund's stakes in Italian bank UniCredit and defence group Finmeccanica

(Reporting By John Irish; Editing by Alexandria Sage and Andrew Heavens)

No comments:

Post a Comment