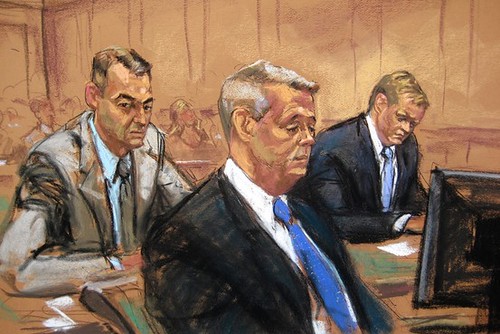

Bankers at UBS convicted of wrong-doing. Very few bankers have been indicted for criminal conduct., a photo by Pan-African News Wire File Photos on Flickr.

U.S. Set Back on Bid-Rig Sentencing

A federal judge sentenced three former employees of UBS AG's municipal-bond desk to much lighter prison terms than the U.S. government sought, a setback in prosecutors' yearslong investigation into municipal-bond bid rigging.

By LIZ MOYER and AARON LUCCHETTI CONNECT

Reuters

A federal judge sentenced three former employees of UBS AG's UBSN.VX -0.28% municipal-bond desk to much lighter prison terms than the U.S. government sought, a setback in prosecutors' years-long investigation into municipal-bond bid rigging.

U.S. District Judge Kimba Wood of the Southern District of New York handed Peter Ghavami, the former co-head of UBS's municipal-bond reinvestment and derivatives desk, an 18-month sentence. Prosecutors had sought at least 17½ years and as long as 21 years, 10 months for Mr. Ghavami, who also served as the Swiss bank's head of commodities at one point.

The much harsher sentence proposed by the government would have been longer than the 11-year term given in 2011 to Galleon hedge-fund founder Raj Rajaratnam for his insider-trading conviction.

But Judge Wood, a onetime nominee to become U.S. attorney general who also sentenced former Drexel Burnham Lambert executive Michael Milken to 10 years in prison, raised questions about the government's method of calculating losses in the case, which it had pegged at about $25 million.

She also praised Mr. Ghavami's "admirable history" and noted that he faces other penalties including a $1 million fine and deportation to Belgium, where he is a citizen. Because Mr. Ghavami, 45 years old, isn't a U.S. citizen, he also has to serve in a "low security" prison instead of a "miminum security" camp.

One of Mr. Ghavami's former colleagues, Gary Heinz, 40, a former vice president on UBS's municipal-bond reinvestment desk, was given a 27-month sentence Wednesday, while Michael Welty, 49, another former vice president, got 16 months. Prosecutors had asked for at least 19½ years for Mr. Heinz and about 11 years or more for Mr. Welty.

Last summer, a New York jury found the three former UBS employees guilty of leading a scheme that caused municipalities to pay millions of dollars more for bond deals than they needed to pay.

The case dealt with an obscure corner of the bond market in which local governments raise money from investors through bond deals, then invest the proceeds in investment products that banks and others are supposed to sell in a competitive process.

Despite intense public pressure to assign blame for the financial crisis, the government generally has found it difficult to bring criminal cases in recent years. While it has had success in insider-trading prosecutions, some of its high-profile Wall Street prosecutions, including one against two Bear Stearns Cos. hedge-fund managers, fell short at trial.

In the UBS bond-rigging case however, prosecutors sought stiff penalties for actions that took place before the financial crisis, from 2001 to 2006. The three former UBS employees caused cities, states and other municipalities to lose $25 million , the government alleged.

"For years, these executives corrupted the competitive bidding process and defrauded municipalities," said Scott D. Hammond, deputy assistant attorney general in the Antitrust Division's criminal-enforcement program, in a statement.

A Justice Department spokesman declined to comment further.

"We're extremely pleased with the sentence," said Charles Stillman, a lawyer for Mr. Ghavami. Mr. Ghavami intends to start serving his sentence as soon as possible, instead of waiting to see how his appeal of the case turns out, Mr. Stillman added.

Mr. Ghavami's fine of $1 million was five times greater than the maximum suggested by the government.

Messrs. Heinz and Welty were fined $400,000 and $300,000, respectively, both more than the government suggested.

Marc Mukasey, Mr. Heinz's lawyer, said "We're happy that the government's outrageous sentencing request was soundly rejected."

Mr. Welty's lawyer, Gregory Poe, said that the jury acquitted Mr. Welty of wire fraud and said he will appeal the conspiracy convictions, and "we hope to clear his name." He added that his client is grateful that Judge Wood rejected the government's sentencing position.

Over the past half-decade, the Justice Department has pursued the muni-bond cases as part of an effort to punish Wall Street banks for shortchanging cities and states. Prosecutors have enjoyed some victories, so far gathering six convictions and 13 guilty pleas. Several were sentenced before Wednesday, with prison terms ranging from six months to four years. Firms affected by the investigation have paid $745 million in restitution, penalties and disgorgement.

UBS exited from the business in 2008. In 2011 it agreed to pay $160 million to settle its civil case with the Securities and Exchange Commission, including $47.2 million to be returned to affected municipalities. It neither admitted nor denied the charges.

It remains to be seen whether this week's sentencing setback will affect the government's strategy in the other pending sentencing hearings. Two former J.P. Morgan Chase & Co. employees, two former Bank of America Corp. BAC +0.82% employees and three others involved with the case await sentencing. One case remains pending and awaiting trial.

Last year, three former employees of General Electric Co. were convicted for their roles in conspiracies related to bidding for municipal-bond-proceeds reinvestment. Two were sentenced in October to three years in prison and the third received a four-year term.

At the hearing Wednesday, prosecutors argued that the former UBS officials deserved more prison time than the former GE employees, while Judge Wood said she didn't see the cases as that different. She also expressed doubt that anyone could accurately quantify losses in cases where the bidding process had been corrupted.

In the case of the three UBS officials sentenced Wednesday, federal prosecutors also sought fines of $20,000 to $250,000 in the case. Prosecutors called their actions a "sophisticated financial fraud" that went on for years and "victimized municipalities and other bond issuers."

The three were accused of conspiring with other financial companies over bid prices in order to steer investments their way. In the process, municipalities were denied a competitive bidding process that could have saved them money, prosecutors alleged.

Vicki Crow, chief finance official in Fresno County, Calif., a victim of the fraud, said "It's important that the bankers on Wall Street are held accountable for their actions." The county received $1,000 from UBS as part of a larger civil settlement over the issue. She said the county cannot be sure how much it was defrauded, because it is impossible to tell what the actual rate should have been on its deal.

In addition to UBS, Wachovia Corp., J.P. Morgan, GE Funding Capital Market Services Inc. and Bank of America also settled their cases in recent years.

—Mike Cherney

contributed to this article.

Write to Liz Moyer at liz.moyer@dowjones.com and Aaron Lucchetti at aaron.lucchetti@wsj.com

No comments:

Post a Comment