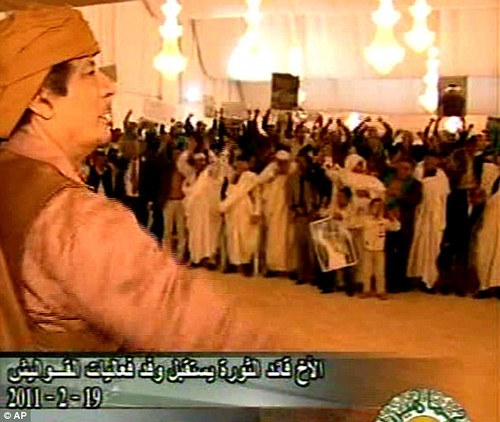

Libyan revolutionary Muammar Gaddafi and his supporters demonstrate their animosity toward the US imperialist-led war against this North African oil-rich state. Libya fought for eight months in defense of their country., a photo by Pan-African News Wire File Photos on Flickr.

JANUARY 30, 2014, 1:22 PM

Libyan Investment Fund Sues Goldman Over Loss

By JENNY ANDERSON

New York Times

Col. Muammar el-Qaddafi was still the Libyan leader when the country’s sovereign wealth fund began investing with Goldman Sachs.

Updated, 7:01 p.m.

Libya’s sovereign investment fund has filed a lawsuit against Goldman Sachs in London’s High Court, claiming that the bank made more than $1 billion in derivatives trades that became worthless, but left Goldman with a profit of $350 million.

The suit, filed by the Libyan Investment Authority last week but detailed on Thursday, says that Goldman Sachs abused its relationship “of trust and confidence” in entering into the trades, adding that the bank did not keep adequate records about the trades. Throughout the suit, the sovereign fund describes an imbalance between its young and inexperienced staff and Goldman’s savvy bankers, an imbalance, the fund says, the firm abused.

In a news release on Thursday, Abdul Magid Breish, chairman of the Libyan Investment Authority since June 2013, said: “While Goldman Sachs was orchestrating these unjustly exploitative transactions, it repeatedly told the L.I.A. that it sought a long-term relationship with the L.I.A. as a strategic partner. This was untrue.”

“We think the claims are without merit, and will defend them vigorously,” said a spokesman for Goldman Sachs. The bank has 14 days to respond to the suit.

Goldman is not the only company that lost money for the sovereign fund, but it is the only one that the fund is suing, a spokesman for the fund confirmed. The United Nations lifted sanctions against Libya in 2003, and the United States and British governments encouraged banks and corporations to do business with the country, then led by Col. Muammar el-Qaddafi. In 2011, as the country sank into civil war, sanctions were reinstated and Goldman Sachs cut all ties (though, according to the Libyan fund, all the money in the investments was already lost).

In fall 2007, Goldman Sachs made a presentation to the Libyan Investment Authority explaining that it wanted to establish a “partnership” with the sovereign fund, the suit says. The bank offered to train authority employees and senior management about the financial markets and products, offering it strategic long-term advice and opportunistic investment options. According to the suit, the bankers said that they were interested in a long-term relationship, not short-term profits.

But a series of equity option trades worth more than $1 billion did not live up to that billing, the suit contends. The trades were inadequately documented by the bank and, when the sovereign fund asked for the records, it took weeks or months for the firm to provide them, the suit says.

According to the suit, Goldman agreed in 2008 to hire as an intern the brother of the sovereign fund’s deputy executive director, Mustafa Mohamed Zarti, at both its London and Dubai offices. The suit does not say whether he actually did the internship.

The suit also says the fund made the investments “without a clear understanding of the nature of the trade or the risks involved.”

The accusations are likely to hit a few nerves. Goldman likes to make money, for itself and its clients. And it has been described by competitors and sometimes by customers as putting its interests above those of its clients. The accusation stood in stark contrast to the firm’s No. 1 business principle, “Our clients’ interests always come first.”

Goldman formed a business standards committee in 2010 to look at how it interacted with clients, including conflicts of interest, disclosure and suitability of investments. The committee, which continues to meet, made 39 recommendations, which, the bank says on its website, it has carried out.

A version of this article appears in print on 01/31/2014, on page B7 of the NewYork edition with the headline: Libyan Investment Fund Sues Goldman Over Loss.

No comments:

Post a Comment