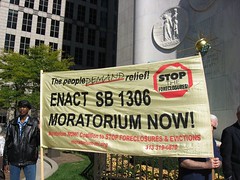

Members of the Moratorium Now! Coalition to Stop Foreclosures and Evictions demonstrate at Detroit City Hall on Oct. 10, 2008. (Photo: Alan Pollock).

Originally uploaded by Pan-African News Wire File Photos

Voices That Dominate Wall Street Take a Meeker Tone on Capitol Hill

By SEWELL CHAN

New York Times

WASHINGTON — Summoned to Capitol Hill to explain their companies’ roles in the worst economic downturn since the Depression, leaders of four big Wall Street banks offered a largely clinical take on the financial crisis on Wednesday, pointing to lapses in risk management and government regulation but offering little sense of the turmoil’s human toll.

Testifying to the Financial Crisis Inquiry Commission, the body established by Congress to determine the causes of the Wall Street debacle, Lloyd C. Blankfein, the chairman and chief executive of Goldman Sachs, drew most of the fire.

Mr. Blankfein parried repeated questions over his bank’s extraordinary profits and salaries. At one point, when he likened aspects of the financial crisis to a “hurricane” and similar acts of God, the commission’s chairman, Phil Angelides, a Democrat and former California state treasurer, cut in to say, “Acts of God, we’ll exempt. These were acts of men and women.”

Mr. Angelides and the other commission members challenged the bankers on executive pay and reckless underwriting and trading, often in withering terms.

Like Mr. Blankfein, the other bankers — Jamie Dimon of JPMorgan Chase, John J. Mack of Morgan Stanley and Brian T. Moynihan of Bank of America — offered measured support for tougher financial regulations that would include raising banks’ capital reserve requirements and reducing the danger of systemwide risk.

The House last month adopted a broad overhaul that would give the government new powers to break up huge companies, create a new consumer financial protection agency and tighten oversight of derivates trading. The Senate has yet to vote on the measure.

With scores of cameras trained on them, the four bank chiefs were sworn in under oath, and then spoke in details so technical that they were numbing at times. None apologized, though some expressed sentiments close to contrition.

Mr. Blankfein, who in the past has said that Goldman should apologize, on Wednesday only hinted at regret. Goldman “got caught up in and participated and therefore contributed to elements of froth in the market,” he said.

Regulators are investigating whether Goldman Sachs and other Wall Street firms deliberately packaged troubled mortgages and passed the bonds off as sound investments even while Goldman and the other banks bet against those bonds, a point on which Mr. Angelides pressed Mr. Blankfein.

“I do think that the behavior is improper,” Mr. Blankfein said, adding, “We regret the consequence that people lost money in it.”

And when Mr. Blankfein said that buyers of mortgage-backed securities were primarily professional investors, Mr. Angelides interrupted to point out that those investors were “representing pension funds who have the life savings of police officers, teachers.”

Mr. Dimon said there had been regulatory deficiencies, but added, “I blame the management teams 100 percent, and fault no one else.”

Reflecting on the volatility that has rocked the markets, he recalled, “My daughter called me from school one day and said, ‘Dad, what’s a financial crisis?’ And, without trying to be funny, I said, ‘This type of thing happens every five to seven years.’ And she said, ‘Why is everyone so surprised?’ ”

One commission member, Byron S. Georgiou, a lawyer, said that no one involved in underwriting exotic securities — investment bankers, lawyers, accountants and rating agencies — was accountable for the risk. The outcome might have been different, he said, if the participants had been made to “eat their own cooking.”

Mr. Mack embraced the analogy. “We did eat our own cooking — and we choked on it,” he said.

The four banks represented at Wednesday’s hearing have mostly returned money they received through the Troubled Asset Relief Program, the 2008 effort that pumped capital into banks in an effort to spur lending. Officials from two of the biggest beneficiaries of that bailout, Citigroup and the American International Group, are expected to face the commission soon.

While Mr. Blankfein acknowledged that “government action was critical” in limiting the problems, Mr. Angelides told him: “I’m troubled by your inability to accept the probability or certainty that your firm would not have made it through the storm but for the vast array of federal assistance.”

Mr. Angelides, deploring the lack of accountability for the crisis, said: “Maybe this is like the ‘Murder on the Orient Express’: everyone did it.”

The commission, which has to deliver a report to President Obama and Congress by Dec. 15, is to hear on Thursday from Eric H. Holder Jr., the attorney general; Sheila C. Bair, chairwoman of the Federal Deposit Insurance Corporation; and Mary L. Schapiro, chairwoman of the Securities and Exchange Commission.

Javier C. Hernandez contributed reporting from New York.

No comments:

Post a Comment