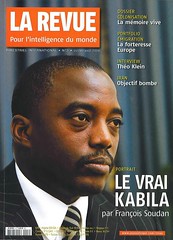

President Joseph Kabila on cover that reads "La Revue". The Democratic Republic of Congo has established joint military monitoring agreements with neighboring Rwanda and Uganda in order to curb rebel activity in the eastern region of the country.

Originally uploaded by Pan-African News Wire File Photos

July 1, 2010 at 1:15 PM

KINSHASA, Democratic Republic of Congo, July 1 (UPI) -- The battle for Africa's oil wealth is heating up.

The Democratic Republic of Congo is opening oil exploration in Lake Albert while longtime rival Uganda tries to put the squeeze on oil majors Total of France and the China National Offshore Oil Corp.

Meantime, Brazil, a rising oil power itself, has extended a $1 billion line of credit to Angola, Africa's largest oil producer and fellow former colony of Portugal.

That will boost the prospects of state-owned Petroleo Brasileiro getting a substantial piece of Angola's untapped offshore riches in the Atlantic. Brasilia recently stated Petrobras plans to invest more than $3 billion in the Angolan oil sector through 2012.

But the energy-hungry Chinese are snapping at Brazil's heels and are said to have paid $1.4 billion in signature bonuses alone in Angola's licensing round in 2006.

There have been reports the Luanda government could launch another oil-licensing round at year-end. "Whenever that day comes," observed the U.S. global security consultancy Stratfor, "the Chinese are expected to make a major push to win fresh blocks."

Uganda's Oil Ministry estimates there are reserves totaling the equivalent of 2 billion-6 billion barrels of crude in the Lake Albert basin.

These reserves pale beside those of Saudi Arabia, at 350 billion barrels, or Iraq, with 115 billion, with possibly as much again in still-untapped deposits.

But for Africa that spells big money. For the corruption-ridden regimes in power, this means immense wealth, little of which trickles down to the populations at large.

The scramble for these riches has exacerbated tribal rivalries, as is now happening in Uganda, and tensions between the major powers in the continent.

Congolese President Joseph Kabila has been procrastinating over oil exploration in his nation's section of Lake Albert for four years. But he signed decrees June 18 awarding blocks 1 and 2 to companies owned by well-connected South African tycoon Khulubuse Zuma.

He's the nephew of South African President Jacob Zuma and has mining interests with companies headed by Nelson Mandela's grandson, Zondwa Gaddafi Mandela.

Zuma has been seeking for some time to extend South Africa's influence northward into states sprawled over the continent's immense mineral wealth.

The emergence of significant oil fields stretching from the Gulf of Guinea on the west coast across to Sudan and Kenya in the east has spurred his ambitions.

The DRC and Uganda are at odds over national boundaries in Lake Albert and this has held up all-out exploration. Efforts are under way to defuse the dispute so that both countries can benefit but no agreement has been reached.

The DRC is also scrapping with Angola over maritime boundaries on the continental shelf, where Angola's Block 15 is operated by Exxon Mobil of the United States.

There's no resolution in sight for that dispute either. Kabila, mired in a seemingly endless civil war, largely over resources, is anxious to avoid provoking Angola, which deployed troops in the DRC to help protect his government from Rwanda-backed rebels and other rivals.

Angola has proven reserves of 13 billion barrels and has ambitions of unseating South Africa as the dominant power in southern Africa.

Exploration in the Lake Albert basin began in earnest in 2007, with strikes by wildcat independents like Tullow Oil of Britain and Heritage of Canada.

Now the big boys are moving in. Tullow, which is acquiring Heritage's stakes for $1.5 billion, wants to split its three blocks with Total and the Chinese, in return for investment of $5 billion.

Each would hold 33 percent in a three-way partnership. But Ugandan regulators haven't approved that deal.

The Africa Energy Intelligence Web site in Paris reports that Uganda's Finance Ministry "has been holding out for $400 million" in key money as well as pledges to invest in domestic refining and electricity generation.

Total chief Christophe de Margerie sought to break the logjam in talks with Ugandan President Yoweri Museveni June 25 but as far as is known the issue hasn't been settled.

Uganda is to begin production later this year and could hit 350,000 barrels a day by 2015. That would make it the fourth of fifth largest producer in Africa.

No comments:

Post a Comment