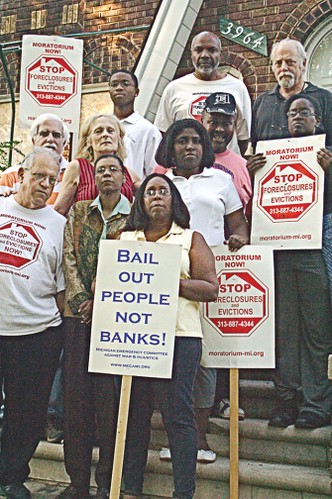

Members of the Moratorium NOW! Coalition to Stop Foreclosures, Evictions and Utility Shut-offs along with the People Before Banks, stand in front of vacant home in East English Village in Detroit. (Photo: W. Kim Heron), a photo by Pan-African News Wire File Photos on Flickr.

Fed actions to reduce mortgage rates may be helping banks more than borrowers

By Danielle Douglas, Published: October 12

JPMorgan Chase and Wells Fargo, the nation’s largest mortgage lenders, said Friday they won’t make home loans much cheaper for consumers, even as they reported booming profits from that business.

Those bottom lines have been padded by federal initiatives to stimulate the economy. The Federal Reserve is spending $40 billion a month to reduce mortgage rates to encourage Americans to buy homes. Instead, its policies may be generating more benefits for banks than borrowers.

“The government can’t force banks to give out loans at lower rates any more than they can force Macy’s to sell me sheets for a dollar,” said Karen Shaw Petrou, managing partner at consulting firm Federal Financial Analytics.

Since the Fed announced its mortgage initiative, rates have ticked down. But banking analysts say the cost of issuing the loans has fallen much more, significantly boosting bank profits.

Timothy Sloan, chief financial officer at Wells Fargo, said on a conference call with analysts Friday that lowering prices would not be “a good decision from a profit standpoint.” Asked whether the company was concerned about losing market share once demand for refinancing declines, he said, “We don’t run the business based upon share; we run the business based on profitability.”

At JPMorgan, chief financial officer Doug Braunstein largely echoed those sentiments: “We’re not going to price a lot lower to create demand. . . . These are competitive businesses, and we have to compete.”

Banks have said they are overwhelmed with demand now, giving them little reason to lower rates further. Eventually, that volume will thin out, however, researchers at the Mortgage Bankers Association said.

Banking executives at Wells Fargo and JPMorgan said a future decline in demand may still not prompt them to lower rates to gain more customers. One official added that he even expects mortgage rates to rise next year.

These comments came as the two banks reported sharp growth in their home loan businesses.

Revenue from mortgages was up 57 percent in the third quarter compared with the same period last year at JPMorgan and more than 50 percent up at Wells Fargo.

“We believe the housing market has turned the corner,” JPMorgan chief executive Jamie Dimon said in a news release. During the earnings call, he said he anticipates demand for mortgages to remain high for many months considering the firm’s backlog of applications.

The reason why mortgage bankers are seeing so much green is that the gap has widened between what banks charge a homeowner in interest rates and what they must pay those who finance mortgage lending. The latter has dropped significantly, largely as a result of the Fed’s actions, analysts said.

With such large profit margins, government officials hope banks will eventually drop rates for homeowners. But they cannot force the companies to do so.

“Banks are in the business of making money and are not going to cut their profit margins for the social good,” said Paul Miller, a former examiner with the Federal Reserve Bank of Philadelphia and an analyst at FBR Capital Markets.

When asked about the conference call comments, Wells Fargo spokeswoman Vicki Adams said, “There are a number of factors that impact pricing, specifically things like guarantee fees and other fees associated with origination and servicing. But the good news is that we’re comfortable managing those changes.”

Officials from JPMorgan declined to comment, beyond its remarks in the conference call.

Miller noted that mortgage and refinance applications would explode if banks lowered rates further. When Wells cut rates in mid-September, the bank was flooded with more customers than it could handle and promptly raised rates to slow the volume.

Bankers say they are also hesitant to expand their mortgage operations because of stricter federal standards.

Government-sponsored entities Fannie Mae and Freddie Mac, which guarantee home loans, have become more insistent about banks taking responsibility for their own troubled loans. Banks worry that if the economy slows they could be saddled with too many sour mortgages.

But some analysts think even the big banks may change their tune as competition heats up for new home loans.

Petrou, the managing director at Federal Financial Analytics, said she suspects that banks may feel compelled to reduce rates “if there were competitive forces” at play.

Added consumer advocate John Taylor of the National Community Reinvestment Coalition: “There is this pent-up market for homeownership that will eventually drive the housing market. . . . What bank is going to sit there and have their lunch eaten by competitors?”

Former Fannie Mae economist Thomas Lawler, who now runs Lawler Economic and Housing Consulting, said consumers should shop around when looking for a loan.

“There are still enough mortgage lenders out there who should be able to undercut the big guys,” he said. “You may see the smaller guys get more aggressive.”

Zachary A. Goldfarb contributed to this report.

5 comments:

All in all, a reverse mortgage CAN be a good financial tool, if you know the facts before you get involved with one.

reverse mortgage leads

Loan modification is defined as a permanent change in the terms of the mortgage where the mortgage is modified to bring it under an affordable reach of the borrower.

loan modification program

Clearly, the people have a clearer stand on this matter. The government must be more considerate of the people because they are their priority more than anything else. Organizations can still stand on their own despite some adjustments, while some people might succumb to financial burdens.

Nannie Toller

We help you to compare and find the best mortgage rates according to your plan.

Mortgage rates continued to inch lower on average after rising to the maximum points since September at the end of previous week. There were no significant market moving proceedings following the move, but rather, rates markets are simply consolidating after last week's fast-paced changes.

best mortgage rates

Post a Comment