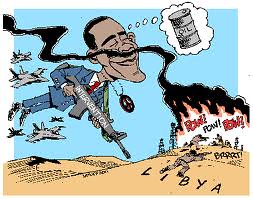

The U.S. imperialists attacked the North African state of Libya in order to seize the oil-rich country and establish a military beachhead inside the region. Thousands have died in the imperialist war., a photo by Pan-African News Wire File Photos on Flickr.

Libya Oil Output Slides as Power Cuts Mix With Protests

By Christopher Stephen and Alessandra Migliaccio - Jul 9, 2013

Since the overthrow of Muammar Qaddafi in 2011, Libya’s oil industry has become the target of violent attacks and civil protests. The latest challenge is a lack of electricity.

Production dropped 16 percent to 1.13 million barrels a day last month, the lowest since January, according to data compiled by Bloomberg. The decline is partly because power shortages are disrupting the pumps that lift oil from beneath the ground, said Abdel Jalil Mayuf, a spokesman for state-run Arabian Gulf Oil Co., which pumps crude in eastern Libya.

The oil and natural gas industry makes up more than 70 percent of Libya’s economy and generates almost all the state’s revenue, according to the International Monetary Fund. Falling output is also a challenge for international companies including Italy’s Eni SpA (ENI), which gets more output from Libya, North Africa’s largest producer, than any other country.

“The country has been through a tumultuous time,” said Sana Abid, an oil analyst at KBC Energy Economics. “It looks bleak for Libya at the moment. They are going to struggle and that’s reflected in declining output.”

Austrian producer OMV AG (OMV) said today its fields in Libya, which produced 30,000 barrels a day last year, have been shut since June 25 because of the political situation.

The Libyan government is trying to address the problems facing oil producers, quadrupling the size of a special guard to protect the industry from attacks to 12,000 people this year.

To ensure electricity supply, Libya signed a deal with London-based contractor APR Energy Plc (APR) to provide 450 megawatts of power through mobile generators, the largest ever single contract for temporary power supply.

Major Upgrading

“Stop-gap solutions are unlikely to be enough,” John Hamilton, a director at U.K.-based consultant Cross-Border Information, said in an interview in Tripoli. “Power generation and a major upgrading of power lines crossing hundreds of miles of desert are essential to keep production at existing levels.”

Civil protests at oil fields, where demonstrators have demanded jobs and changes in the way oil revenue is distributed, have cost Libya about 250,000 barrels a day in lost output, Oil Minister Abdulbari Al-Arusi said last month. Production is now 30 percent below the post-revolution peak of 1.6 million barrels a day reached last July.

Violence is also a risk. A shooting in June near Zueitina, a city in eastern Libya with a major oil export terminal, left an employee at power grid supplier ABB Ltd. (ABBN) and a contractor injured, according to state-run news agency LANA.

The Tripoli headquarters of the Defence Ministry Petroleum Facilities Guard was stormed by militiamen from Zintan late last month, leading to a gun battle in the streets of the capital that left at least six people injured.

Security Problem

“There is a general security problem in the country,” Total SA (FP) Chairman and Chief Executive Officer Christophe De Margerie said in an interview. “We have reduced our expatriate staff a little so that in case of a big problem we can evacuate more quickly.”

Demonstrations have been held at terminals in Tobruk and Zueitina -- shut down at least four times since November -- and at the Al-Fil oil field in the south, Al-Arusi said. Eni was forced to halt gas exports to Europe through its Greenstream pipeline for a week this year.

An explosion in April at pipelines serving Zueitina also heightened tensions after LANA reported it was a rocket-propelled grenade attack, citing an army officer. While the state-run National Oil Corp. called it an accident, results from an investigation haven’t been released.

“The way in which the Libyan institutions will settle down is at the center of our attention,” Eni CEO Paolo Scaroni said in an interview last month. “In principle, there are all the reasons to get to a peaceful democracy.”

Saharan Wilderness

As well as holding back production, unrest makes some companies wary of looking for new fields in a country with Africa’s largest oil reserves. Explorers have become particularly wary of exploring the wilderness of the Saharan desert after an attack in January by al-Qaeda-linked militants on the In Amenas gas plant in neighboring Algeria left at least 38 foreign workers dead.

“Companies are extremely worried,” said Cross-Border’s Hamilton. “BP said in 2012 they were going to resume exploration in 2013, and here we are, there’s no sign of resuming exploration. A company like BP right now couldn’t commit hundreds of millions of dollars and send large numbers of its employees into the desert.”

BP Plc (BP/) has pulled its foreign workers due to insecurity, though the company remains operational with its Libyan staff, according to a spokesman.

Worsening Relations

Thomas Schmidt, a spokesman for ABB, confirmed an incident had taken place in Libya and he said the company has no plans to leave for the moment. Neither does Total.

The biggest risk for the oil and gas industry may be the worsening relations between the country’s two halves -- western Libya, where the capital Tripoli is located, and the oil-producing regions in the east.

Many of the protests that disrupted oil production in the east were led by federalists seeking a greater share of oil revenue for the region, according to Arabian Oil’s Mayuf. The east is also where U.S. Ambassador Chris Stevens and three colleagues were killed in Benghazi in September.

“Libya’s oil industry is the football that all groups and protagonists seek to kick around,” said Duncan Bullivant, CEO of U.K.-based consulting company Henderson Risk.

To contact the reporters on this story: Christopher Stephen in Tripoli at cstephen9@bloomberg.net; Alessandra Migliaccio in Rome at amigliaccio@bloomberg.net

To contact the editor responsible for this story: Will Kennedy at wkennedy3@bloomberg.net

No comments:

Post a Comment