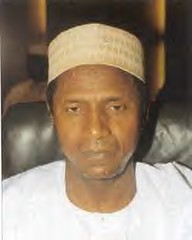

Nigerian President Umaru Musa Yar'Adua. He took over from Olusegun Obasanjo. He says the country will turn over territory in Bakassi to Cameroon.

Originally uploaded by Pan-African News Wire File Photos

NIGERIA'S FOREIGN RESERVES RISE TO 51.3 BILLION DOLLARS

Nigeria's foreign currency reserves rose to 51.32 billion dollars at the end of December 2007 from 49.96 billion in the preceding month, the Central Bank of Nigeria (CBN) said Thursday.

The bank said the reserves had grown steadily in the last three years, driven by high crude oil prices in the international market.

The CBN said the reserves level, which hit 45 billion dollars in 2005, dropped to 32 billion dollars after Nigeria paid 12.4 billion dollars in debt owed to governments in the Paris Club of creditors.

It said reserves began to build from April 2006, when the total came to 37 billion dollars. The total then went to 41.95 billion in December 2006 and to 42.65 billion in the first weeks of 2007.

The Paris Club in 2005 cancelled 18 billion dollars of Nigeria's debt, leaving a total of 12.4 billion dollars, including arrears and interest.

Nigeria, Africa's biggest oil producer with a daily output of 2.6 million barrels at peak production level, derives around 95 percent of its foreign earnings from the oil sector.

N'Assembly uncovers N300b unspent funds

From John-Abba Ogbodo, Abuja

Nigerian Guardian

AN assessment of the execution of the 2007 budget by the National Assembly has shown that about N300 billion voted for various projects by the Executive arm of government was not spent during the period.

Consequently, the House of Representatives, which made the figure public yesterday in Abuja, has agreed to roll over the money to the 2008 Appropriation Bill, now awaiting passage by the legislature.

The disclosure was made on the floor of the Lower House during its plenary session when the Chairman of its Appropriation Committee, Festus Adegoke, presented his report to the chamber.

Deputy Speaker, Alhaji Usman Nafada, after Adegoke's presentation, said N217 billion, including the N7 billion earlier returned to the treasury by the National Assembly, was part of the unspent budget and would be captured in the 2008 budget.

He explained that the lawmakers had taken a critical look at the accounts of the Federal Government and discovered between N70 and N80 billion as unspent budget, saying it would be illegal to keep such money in any account. Nafada, therefore, said that the National Assembly would include the money in the 2008 budget.

The Deputy Speaker put the total amount of unspent fund in the 2007 budget at N300 billion. He confirmed that $678 million was discovered in the signature bonus account and would be utilised in the 2008 budget. According to him, only $100 million would be left for Petroleum Technology Development Fund (PTDF) and henceforth, the National Assembly would no longer allow the Executive to keep any special accounts.

In his report, Adegoke said the House was not able to make good its earlier promise to pass the budget on December 27, 2007 because the information required from the Executive to enable the House to do a better job was not provided. He said that the directive of the Federal Government that capital projects not executed before the end of December last year should be stopped also affected the passage of the budget because the various committees of the House were carrying out oversight functions on ministries with a view to ensuring full compliance.

Adegoke added that the directive made it imperative for the National Assembly to roll over the affected projects, adding that with the directive, it became necessary to roll over those affected.

"In the light of the above, the committee has requested all the ministries, departments and agencies through their respective standing committees to furnish it with reports on the stages of implementation of capital projects so far, for inclusion in the 2008 budget. This is necessary to ensure transparency and accountability while also ensuring that there is no abandonment of projects as a result of the government policy," he said.

He further cited the inconclusive discussion on the issue of benchmark as part of the reasons for the delay in the passage of the budget, stressing that Appropriation and Finance Committees of both the Senate and the House were still meeting to take a position on the matter.

The Speaker, Dimeji Bankole, commended the efforts of the committee, noting that the pain being taken by the National Assembly to do a thorough job had yielded results with the discovery of some unspent funds. He had earlier over-ruled a point of order raised by Friday Etula from Edo State urging the House to stop the debate. Bankole insisted that it was proper for the lawmakers to get to the nitty-gritty of the entire process so that they could pass a realistic budget.

"It is necessary we take every detail of the budget and work on it thoroughly. We have to do a thorough job so that the time we have waited pays off. We must all contribute to the report," he said.

The Chairman of the Committee on Education, Farouk Lawan, supported the position of Bankole, reiterating that in the last eight years, it had been very difficult for the Assembly to discover the special accounts. "In the last eight years, efforts were made to get the Executive to disclose all these figures but nothing came out of it. I concur that the committees be allowed to do a thorough job at least one to two weeks so that the amount of money discovered be utilised in areas that are critical and the benchmark determined," he stated.

Igo Aguma, chairman of the Gas Committee, noted that it was expedient to give the committees more time, adding that he had discovered that even the Nigerian National Petroleum Corporation (NNPC) was in the habit of repeating projects in the budget."

Former Speaker of the House, Mrs. Patricia Olubunmi Etteh, said that time should be taken by the House to do a thorough job because the President still has powers to spend money for at least six months.

"The President still has the powers. He can still spend funds as stipulated in the constitution. We should not and don't stampede the chairmen of the various committees from doing their jobs. If we must do the job, we must do a thorough job," she remarked.

Also, the Appropriation and Finance Committees of both chambers met yesterday and agreed on a new benchmark of $59 per barrel. Its chairman, John Enoh, told The Guardian that the two chambers had been working in harmony to pass the budget on time but for the delay on the part of the Executive to release the information required. "Both chambers, through their committees have been able to establish a benchmark of $59 per barrel and we are in agreement on almost all aspects of the budget. We are ready and willing to pass the budget as soon as we get the information we asked for," he said.

How not to alleviate poverty

Nigerian Guardian Editorial

THE Federal Government's plan to distribute a sum of one billion Naira (N1 billion) to a total of 12,000 poor households for investment in micro businesses under a presidential pet project known as Care for the People Programme (CPP)/Poverty Reduction Accelerator Investment (PRAI) sounds so whimsical, it is embarrassing to say the least.

The project is to be implemented by the National Poverty Eradication Programe (NAPEP), the Office of Millennium Development Goals (OMDGs), and the Small and Medium Enterprises Development Agency (SMEDAN).

According to the Minister of Finance, Dr. Shamsudeen Usman, the funding would come from savings arising from 2005 Paris Club external debt exit arrangement. But where is the equity in this plan to distribute a handsome sum of over N80,000 each to only 12,000 poor households out of an estimated total of more than 70 million poor people.

The promoters of the initiative intend to identify 12,000 poor households in selected states in the six geo-political zones, and then hand over the largesse to their heads - male or female. It is a laughable proposal.

What criteria would be used in identifying the poor households? Besides, throwing money at the poverty crisis is not the best way to empower the people. Are we saying that some people would get some money and others need not?

More interestingly, how is this practice of establishing or assisting 12,000 micro businesses with one billion naira preferable to providing secure electricity to 12,000 poor households or potable water supply to 12,000 houses across the country.

Surely such amenities will not only extend to more than just 12,000 poor homes, the action itself will remove a particular constraint to the livelihood pursuit of more than 12,000 poor people directly and with multiplier effect.

What is more worrying is that having ensured that micro finance banks were established across the country, government is hesitant or even unwilling to allow such institutions to benefit from its general expenditure policy.

It is difficult to understand why government will rather ask NAPEP to distribute such a fund as if it is a bank than go through the micro finance banks, partially or wholly. This is one of the principal reasons the micro finance banks were established in the first place.

It beats the imagination naturally why NAPEP itself will not operate through the banks, given the huge funds already at its disposal to pursue the reduction of poverty across the nation. No wonder it has become a national and natural pipe drain without any visible trace of its path or impact.

The Yar'Adua administration has assured the nation that it holds transparency, accountability and the rule of law as part and parcel of the 'due process' policy. Certainly, this country cannot afford to rely on a NAPEP that has never been accountable to any one except to politicians and civil servants to be further charged with banking responsibilities.

Above all, why is a government that is supposed to arrange most of its programmes around the ultimate liquidation of poverty planning to spend a pittance on a tiny minority of its target population to the utter neglect of suffering millions.

Government is reminded that the last decade has been a huge financial blessing to Nigeria, a period that saw the liquidation of our total external debt of over US$30 billion.

Surprisingly and contrary to the understanding of the external debt exit agreement, we are now faithful in the breach rather than the observance of the terms that require Nigeria to spend money so saved on poverty reduction.

The proposed initiative proves the point, again that our development agenda lacks a principal ingredient: the notion that we have a country to develop and not a few people, whichever way we define our responsibility towards eradicating extreme poverty in our land.

Such a responsibility also requires a lot more urgency than the authorities often care to admit. A government that targets becoming one of the 20 most developed countries in the world just 13 odd years from now should be a lot more ambitious in eliminating development constraints.

Besides, the greatest majority should always be the target of its development objective. Development is all about the efficient use of resource endowment and therefore channels of disbursement of development resources must be carefully chosen with a view to achieving the maximum and widest impact. The era of tokenism and dubious money sharing in development practice is gone.

Given our overall policy of building up and empowering the private sector, and rightly so, government needs to embrace this objective and demonstrate our commitment to it at every opportunity. That is why the private micro finance banks and institutions must be carefully nurtured and given the opportunity to learn and access funds. The appropriate channel of distributing development financial resources is the commercial banking system, including micro finance banks.

The idea of leaving financial resources to some nebulous government agencies to distribute, merely and carelessly abandons such funds to the predatory strangulation by luckless politicians and civil servants. The episode that arose from the Petroleum Technical Trust Fund, which ultimately became a veritable source of slush funds is still too fresh to be easily forgotten.

No comments:

Post a Comment